Many employees are offered group insurance plans through their employer thinking that it's an effective and inexpensive option to obtain life insurance.

In reality, most group plans end up costing the employee more than an individual life insurance policy and without the coverage and benefits that an individual life insurance policy provides.

Simply put, buying your own individual coverage provides you with longer-lasting and superior coverage than a group policy. You may also qualify for preferred rates under an individual plan, an option that's not available in a group plan and can mean tremendous cost savings for the future.

Group Life Insurance

A group life insurance policy provides coverage on each of the individual members of the group, and their dependents, where applicable.

In employer group plans, the amount of basic coverage is usually computed as a multiple of the member's salary, such as two times salary. With professional association group plans, coverage is generally a flat basic amount. Optional coverage can usually be obtained on both the plan member and his or her dependent family members.

Usually basic group life insurance coverage is available without a medical examination or other evidence of insurability from the group members or the dependents of the group members. Additional coverage is subject to evidence of good health. As with personal life insurance, the plan member has the right to name a beneficiary for the coverage.

The premium charged for each group member is based on the average age and sex of all members of the group (a blended rate). This premium rate is then applied to the amount of coverage applicable to each individual group member. Unlike individual insurance plans, group premium rates are not personalized according to the age, sex, and health of each individual plan member.

Individual Life Insurance

An individual life policy is the absolute best way to get adequate coverage for a duration that you need.

However, given the greater coverage, customization and flexibility associated with an individual life insurance policy, each applicant will need to qualify medically to get approved for the policy, which usually requires a medical exam. Your policy will be determined based on your age, build, health conditions, family history and any risky hobbies.

A significant advantage of an individual policy is that the rate is locked in for duration of the policy. Whether you buy a 20-year term or a permanent policy, the monthly premium will be locked in so there are no surprise payment increases.

In addition, an individual policy provides you with the opportunity to obtain the right amount of coverage to protect your family. For example, if you earn $100,000 per year, you can buy a policy for $1 million or $2 million (or more) because 2-3 years of your salary is likely to not be enough. This is one of the biggest mistakes made by those with group policies alone: thinking they have enough coverage. When one sits down and conducts a needs analysis, it becomes quickly apparent that $100,000 to $200,000 (1x-2x income) will not do much for one's family.

Individual policies can also be customized with riders such as child riders, disability and long-term care riders to provide the utmost in customization for your specific needs.

Importantly, individual policies are portable: if you change employers or your company cuts cost and life insurance is one of the perks to go, you can sleep well knowing your policy is not affected.

At the end of the day, unlike a group policy, a client has complete control of their individual policy (not their employer).

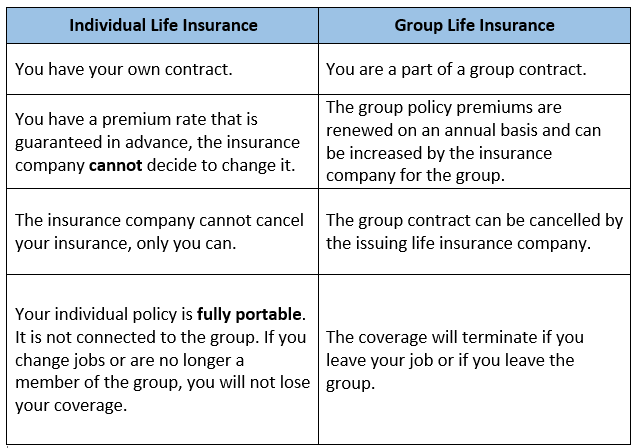

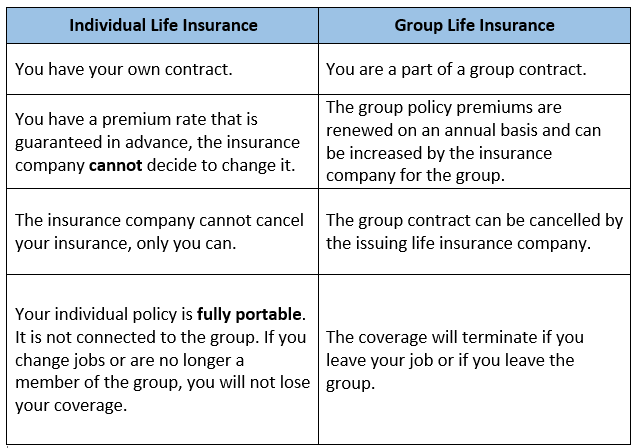

Individual vs. Group Comparison Summary

The table below summarizes the primary differences between individual and group life insurance policies.

Based on a detailed comparison of group versus individual insurance, it becomes clear that it's very important to get an individual life insurance policy. When is the right timing to seek such a policy? Right now! The sooner you contact a professional insurance advisor, the better to secure this vital protection for your family.

Interested in learning more about Life Insurance and how it can protect your family? Download our free ebook: The Beginner's Guide to Life Insurance.