A Health Spending Account (HSA) is a tax-free benefit which allows small business owners and their employees to reduce the cost of medical expenses. While it is similar to health insurance, it does not work in the same way. An HSA works by eliminating the taxes on medical expenses by allowing business owners to pay for medical expenses with pre- (income) tax dollars. As a result, there are tax implications and the plan must abide by the CRA. Here are some general rules to know:

1. Unincorporated Businesses

If you are an unincorporated business or sole proprietorship, your business must have at least one arm's length employee to be eligible for a Health Spending Account. Incorporated businesses are eligible even if it is operated by only the owner.

2. Ontario

The Ontario government has its own unique tax treatment of "insurance premiums" and Health Spending Accounts. There is a 2% special Premium tax and 8% RST on the claimed amount. A 13% HST is also charged on the administration fee amount.

Example of a $1,000 claim in Ontario

1. HSA Deluxe / Plus / Basic

Premium tax: 2% of $1000 ($20)

RST: 8% of $1000 ($80)

No HST because Olympia Benefits plans charge no administration fee

Total: $1,100

Note: these calculations are built into Olympia's platform when Ontario residents are making a claim.

3. Employees vs Shareholders

The owner of the business is eligible for an HSA as long as they can show reasonable proof that they are an employee. A common way to do this is by paying yourself in T4 income. It is not advisable to pay yourself in only dividends as this would make you look like a shareholder in the event that you are audited by CRA.

4. Income Tax Guidelines

There is a lot of technical wording within the Income Tax Act but the key thing you should know is that the HSA was originally known as a Private Health Services Plan (PHSP) and meant to provide small business owners or independent contractors with a way to receive benefits like regular salaried employees.

5. Spousal Insurance

The HSA can work in conjunction with various health insurance plans. Always claim on your health insurance plan first and then claim any remaining, non-reimbursed amounts with an HSA. By following this order, you ensure maximum return.

6. No Double Dip

As previously stated, an HSA deals with tax implications because it effectively turns after-tax medical expenses into before-tax. This means you cannot claim your medical expenses in a tax credit like the Medical Expense Tax Credit (METC) and also claim them through a Health Spending Account.

7. Annual Spending Limit

The amount in the annual spending account is decided in the contract between the employer and the employee. If the amount is increased at will, then there is no reasonable degree of risk. The spending limit is controlled by the administrator (Olympia). The employer can fill out a form in the case where they decide to increase the limit for employees. This same reasonable degree of risk is also present in a rollover.

Other points to consider

How do I file the HSA fees on my company taxes?

They are Employee Benefit Tax Deductions.

Why is an HSA more effective than METC?

Health Spending Accounts were created to benefit small business owners. They are typically much more effective than any existing medical expense tax credit.

Read this article to find out more about the differences and also get access to a METC and HSA calculator.

How does the HSA work in relation to taxes?

If you are an incorporated business with solely owner or owner and spouse, here is how it would work:

An HSA turns your after-tax personal medical expenses into before-tax business deductibles (through your business).

How do taxes impact the cost of my medical expenses?

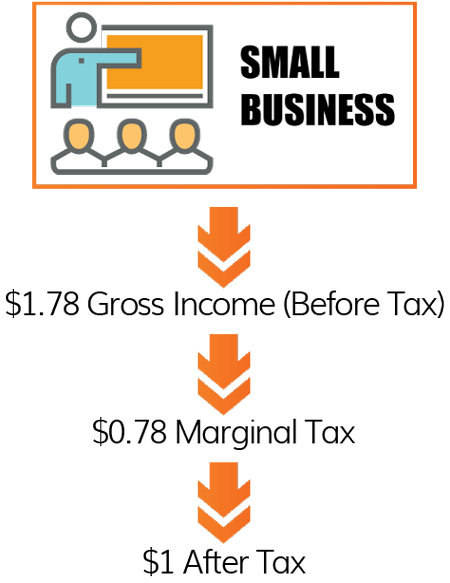

As a business owner, you receive income from your corporation. In Canada, we have a progressive tax structure. Meaning the more income you make, the more the government takes. Your marginal income tax rate will have a significant effect on the total cost of your medical expenses. Your marginal tax rate is the combination of your provincial and federal tax rate.

For example: if you earn $100,000 in Alberta, you would have to gross roughly $1.78 to bring home $1.00 after-tax. $0.78 of your gross $1.78 (or 43%) would be taxed, leaving you with $1.00 after-tax.

Below is an example of a savings comparison between medical expenses paid personally vs. through your business using a Health Spending Account.

Please note that below chart references a resident of Ontario.

On the bottom left (red), you see the true cost to your company when you pay for a $3,000 medical expense personally with after-tax dollars. To get $3,000 you must withdraw $5,340 from your company. $2,340 or approximately 43% (of $5,340) is lost to income tax.

On the bottom right (green), instead of paying the government 43% tax, you pay Olympia an annual HSA membership fee of $499. Your company saves almost $2,000 in (marginal income) taxes with an HSA!

Learn more (business with NO arms' length employees):

Learn more (business with arms' length employees):

Related Reading:

6 Eligible HSA Expenses you may have Overlooked

Top 53 FAQ about Olympia Health Spending Accounts

Health Spending Account Definitions