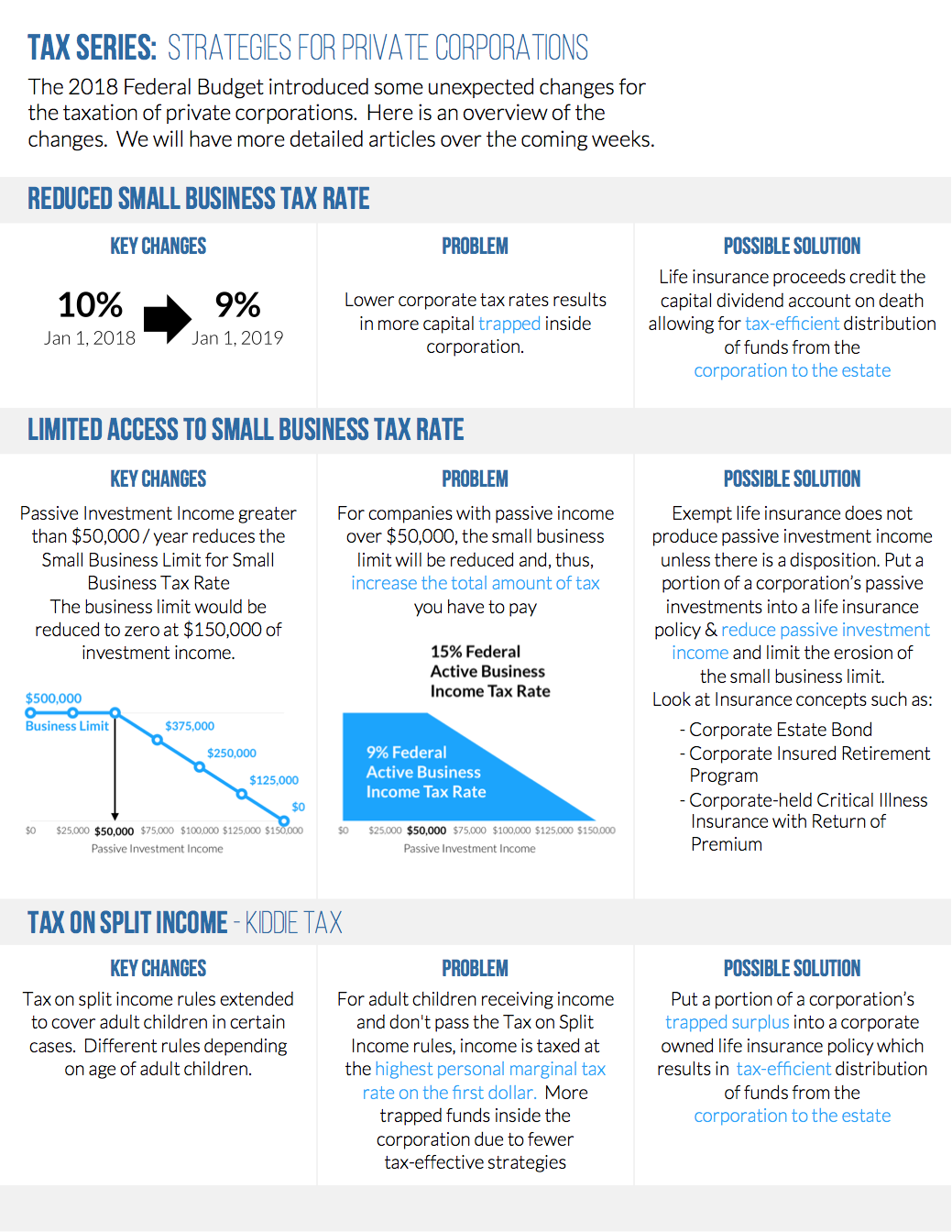

This week, our focus is on passive investment income and limiting access to the small business tax rate.

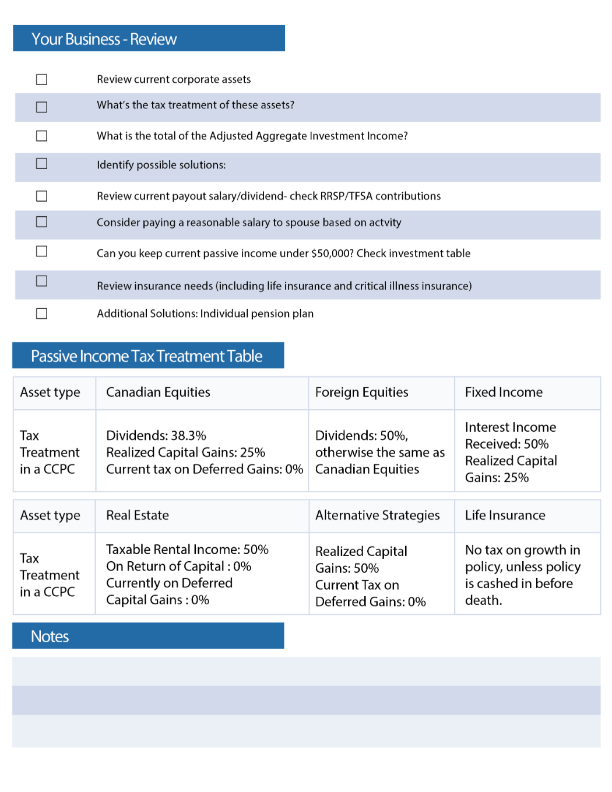

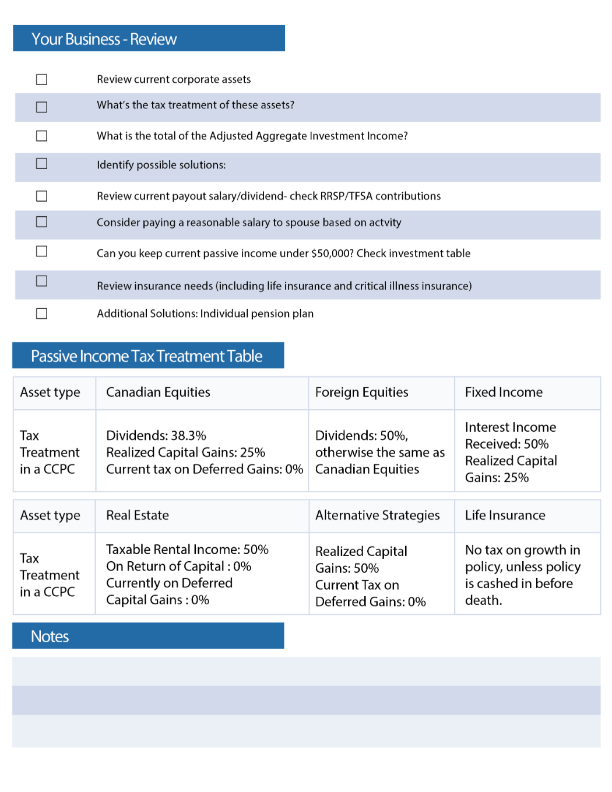

For an advisor if you’re discussing this with a business owner or incorporated professional, here are the key points you should include:

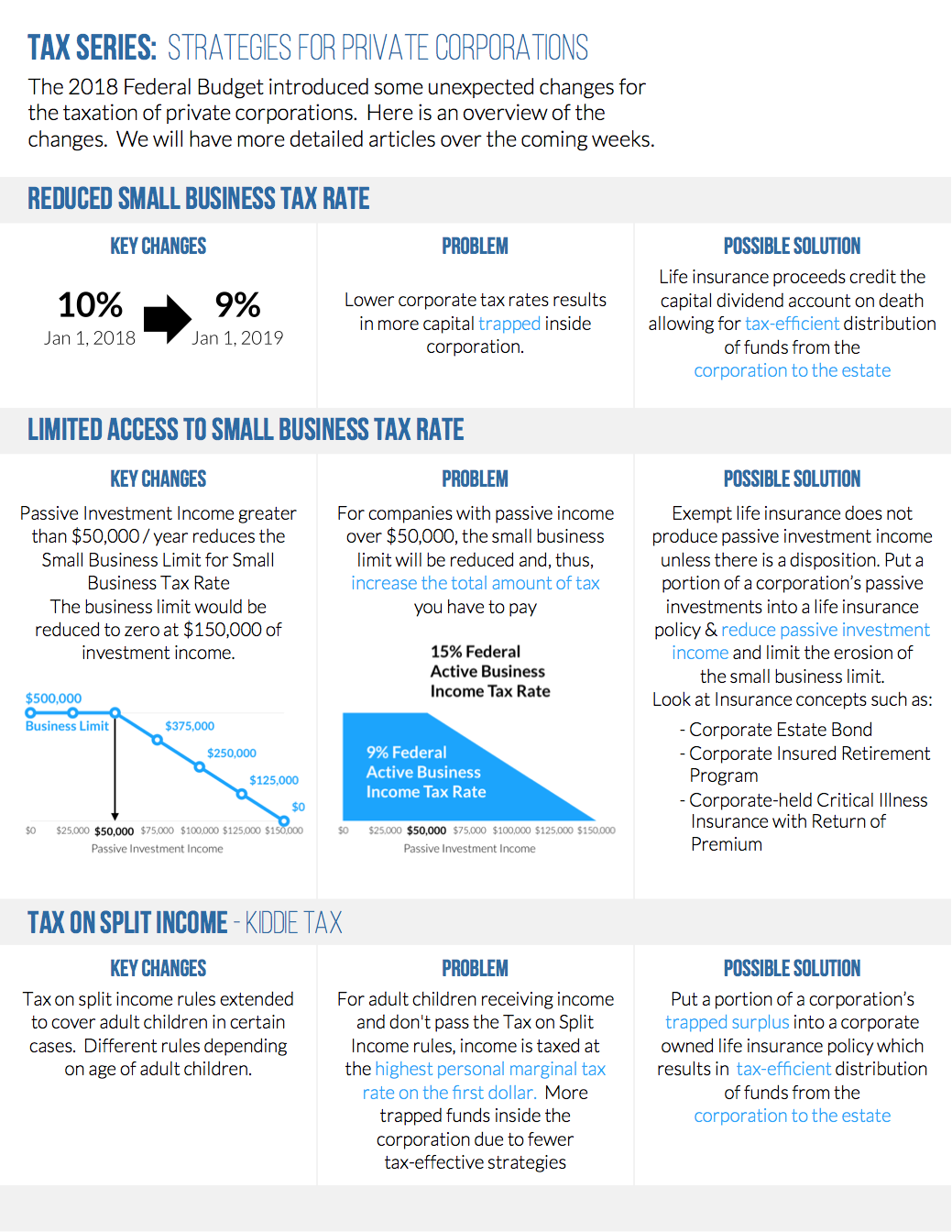

- The government is limiting access to the small business tax rate effective January 1, 2019, therefore it’s time to act now and review your situation.

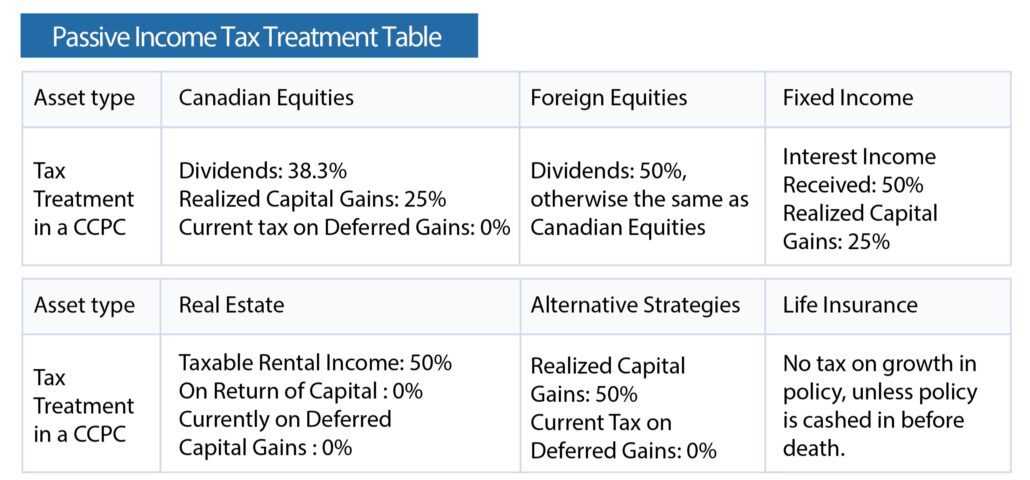

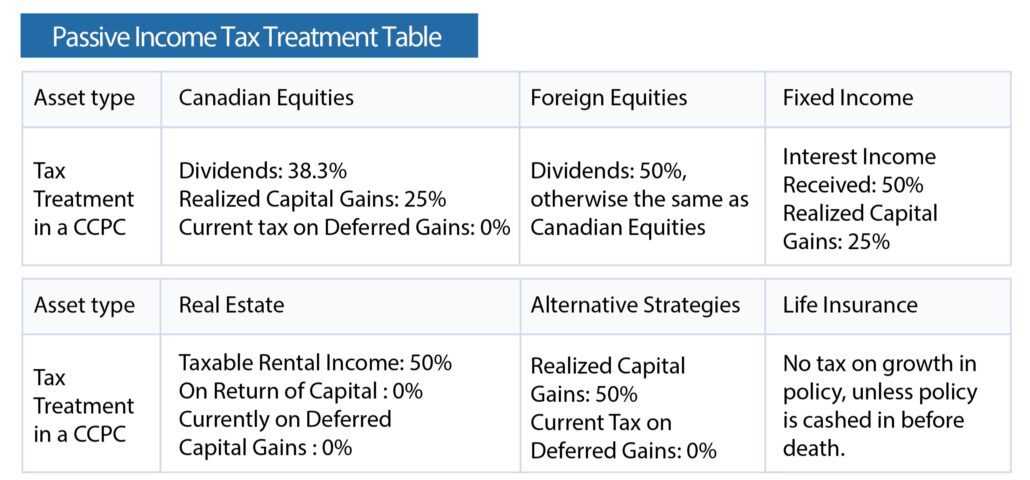

- Let’s review the type of assets your corporation currently holds and the treatment of these assets under the new measures.

- Look at possible solutions including: Corporately-held life/critical illness insurance, Salary/Dividend payout, Individual pension plans and Deferred capital gains.

And of course we’ve put together the following to help you with your discussion:

- Infographic on the changes

- Article to use on your website, email newsletter and social media

- Checklist- to ensure you stay on track during your meeting (including a table on the tax treatment of assets held within a Canadian Controlled Private Corporation)

- Calculator that you can embed on your website.

Calculator How-To:

Click the image above.

Input the Adjusted Aggregate Investment Income (Passive Investment Income) and it will calculate your access to the Small Business Tax Rate.

Remember for Canadian Controlled Private Corporations (CCPC) that income below $500,000 will be taxed at the federal small business tax rate of 9% and above $500,000 will be taxed at the federal active business income tax rate of 15%.

Below the calculator you will also find the table on the tax treatment of assets held within a CCPC.

Morneau’s federal budget announced earlier this year informed us how the government will treat passive income in a Canadian Controlled Private Corporation. (CCPC) The government’s main concern was that under the current rules a “tax deferral advantage” exists since tax on active business income is usually lower than the top personal marginal tax rate. Therefore if the corporate funds were invested for a long period of time, shareholders might end up with more after-tax amount than if it was invested personally.

Limiting Access to the Small Business Tax Rate

A key objective of the budget is to decrease the small business limit for CCPCs with a set threshold of income generated from passive investments. This will apply to CCPCs with between $50,000 and $150,000 of investment income. It reduces the small business deduction by $5 for each $1 of investment income which falls over the threshold of $50,000 (also known as the adjusted aggregate investment income). This new regulation will go hand in hand with the current business limit reduction for taxable capital.

The time to act is now, since these changes will be effective January 1, 2019, a discussion and plan should be prioritized now, since 2018 will be the “prior year” of 2019. To avoid the reduction of income eligible for the small business tax rate, business owners need to minimize or keep the amount below $50,000 of the “adjusted aggregate investment income” (AAII) in 2018.

We’ve listed some solutions on how to do this:

1) Corporate Owned Insurance: Exempt life insurance does not produce passive investment income unless there is a disposition. Put a portion of the corporation’s passive investments into a life insurance policy and reduce passive investment income and limit the erosion of the small business limit. Insurance concepts:

- Insured retirement program: Provide additional retirement funding through transferring excess corporate funds into whole life or universal life insurance. The funds inside the policy grow “tax free” to create significant cash value. At some point when there is a need for cash, the policy is pledged as collateral for a bank loan. The bank loan doesn’t need to be repaid until the life insured dies and the death benefit is used to repay the loan. Any remaining death benefit is paid out.

- Estate bond: Transfer corporate wealth to the future generation by utilizing whole life or universal life insurance. Essentially replace taxable investment with life insurance, increase funds for a future generation upon death, reduce tax and create a strategy to move funds out of the corporation tax free (through the Capital Dividend Account.)

- Corporate held Critical Illness with Return of Premium: Purchase corporate owned critical illness, since it doesn’t produce any investment income.

2) Pay enough salary/dividends to maximize RRSP and TFSA Contributions: A salary of $145,722 will allow the max 2018 RRSP contribution is $26,230 (18% of $145,722). Make sure you also pay enough salary/dividend to maximize your annual $5,500 TFSA contribution.

3) Individual Pension Plan (IPP): The corporation contributes to the IPP and income earned in the IPP doesn’t belong to the corporation. This should only be considered when the AAII is over $50,000.

4) Deferred Capital Gains: Capital gains are 50% taxable and are only 50% included in the AAII.

Financial Tech Tools helps financial advisors grow their business by providing professional websites, calculators and online marketing. Professional websites, content, email and social media marketing done by financial industry experts that have their CFP, CLU, CHS and EPC designations. With over 25 years of financial services experience we speak "advisor", talk to us and we can help grow your business:

Financial Tech Tools helps financial advisors grow their business by providing professional websites, calculators and online marketing. Professional websites, content, email and social media marketing done by financial industry experts that have their CFP, CLU, CHS and EPC designations. With over 25 years of financial services experience we speak "advisor", talk to us and we can help grow your business: