One-in-three working Canadians will experience a period of disability lasting longer than 90 days during their working lives, according to statistics.

But a new study conducted by Ipsos Reid suggests nearly half of Canadians underestimate how frequently disability actually occurs.

When it comes to disability, what Canadians don’t know can hurt them. The research indicates that Canadians are overly optimistic about avoiding a disability and that lack of understanding reinforces the need for more education around this critical issue.

In reality, 62% of Canadian workers have been exposed to someone having taken time off of work due to a disability, with 25% having had taken this time themselves.

Even a temporary disability could affect your ability to work and take home a pay cheque. Without disability insurance to help cover expenses, many families would find themselves in financial trouble. A separate study released earlier this month revealed 51% of workers would find it difficult to meet their financial obligations if their pay cheque were delayed by a single week.

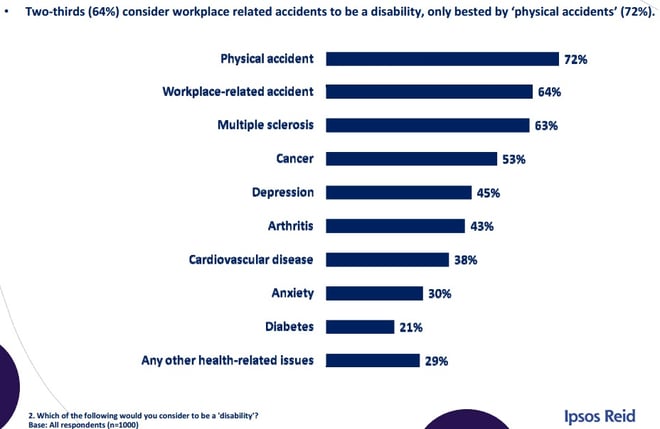

The numbers also reveal that less than half of Canadians consider conditions such as depression and arthritis a disability along with terminal illness and physical accidents. The results of what Canadian consider to be disabilities are summarized below.

The results clearly indicate there is a mistaken perception that disabilities tend to be catastrophic in nature—caused by one-time, traumatic events. Most Canadians don’t recognize that common, chronic conditions such as mental illness cause the majority of disabilities. In fact, less than 10% of disabilities are caused by accidents.

The top reason Canadians cited for not purchasing individual disability insurance is because they believe they have enough coverage through their employer. And, more often than not, this tends not to be the case. That's why it’s certainly a good idea to double check whether you are indeed covered and what the extent of that coverage is.

Simply put, if you underestimate the possibility of becoming temporarily disabled then you are putting yourself and your family at significant risk.

Related reading: The Basics of Filing a Disability Insurance Claim in Canada

Interested in learning more about Disability Insurance and how it can protect you and your family? Register to attend our free webinar: "An Introduction to Disability Insurance".