Sitting at the threshold of the greatest intergenerational transfer of wealth, in which an estimated $30 trillion dollars will pass from baby boomers to the next generations over the next three or four decades, financial advisors could be looking at an unprecedented opportunity for growth or they could be facing the greatest threat to their survival.

With many firms already looking ahead to Robo Technology, most have yet to put the essential pieces in place to position their financial advisors competitively in the digital world. What stands in the way of becoming a “digitized advisor”?

Barriers to Becoming Digital

1. Slow adoption

2. Aging advisor population

3. Compliance

Key Elements of Going Digital

1. Fresh, compelling, original digital content

- It keeps the user on the site, and/or keeps them coming back. Whether it's the content on the web pages, blog posts, podcasts, or the availability of webinars; fresh,

compelling, well-written, digital content is the primary driver of user “stickiness,” increasing the chance for interaction with the advisor.

compelling, well-written, digital content is the primary driver of user “stickiness,” increasing the chance for interaction with the advisor.

- It can be what differentiates the advisor. Fresh content that is published daily, weekly, or, at a minimum, monthly, offers the greatest insight into the practices, methods, expertise, and philosophy of the advisor that users look

for.

for.

- It's essential to raise the visibility of the advisor. It is content that establishes the advisor as an authority and helps them build influence in their target market. It’s also what the search engines respond to in ranking websites. Websites that contain always fresh, relevant, compelling content rank much higher than those that don’t. ·

It is what spurs the call-to-action. Financial advisors with well-placed content consistently receive calls from clients or prospects responding to an article or podcast.

It is what spurs the call-to-action. Financial advisors with well-placed content consistently receive calls from clients or prospects responding to an article or podcast.

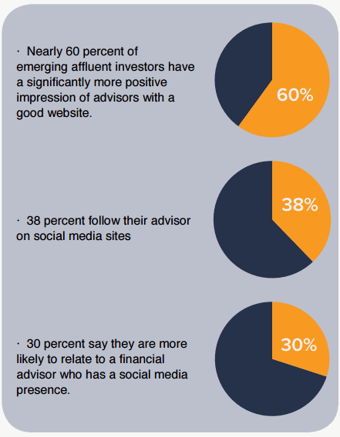

2. Integrated Social Media

- With a social media presence, financial advisors create the opportunity to engage with potential clients wherever they are. The objective of social media

engagement is not to “sell” or even offer your services; rather it is to establish yourself as an authority (and a friendly person) who is willing to engage with

engagement is not to “sell” or even offer your services; rather it is to establish yourself as an authority (and a friendly person) who is willing to engage with other over topics that are important to them. The goal is to increase visibility, make connections, and cultivate relationships.

other over topics that are important to them. The goal is to increase visibility, make connections, and cultivate relationships.

3. Responsive Website Design

- Once thought to be a luxury of website design, responsive or mobile-friendly design is quickly becoming an essential requirement. Each year, as the

number of different types of devices, platforms and browsers increase, web design has to take into account all of their various sizes and shapes in order

number of different types of devices, platforms and browsers increase, web design has to take into account all of their various sizes and shapes in order

to able to deliver an optimal web experience. With more users (especially next generation clients) relying on mobile devices to browse the Internet, a website must be able to respond to the screen size and orientation of the device.

What do you find is holding you back from going digital?

Interested in learning more? Advisor Websites will be hosting a webinar August 10th to share best practice strategies and solutions for digital marketing!

To learn more about Advisor Websites and the company's web building platform, visit the website: www.advisorwebsites.com or contact Nitesh Verma at niteshv@advisorwebsites.com or (604) 800-3307.