As a small business owner, you may wonder if you should pay yourself a salary or dividends? When should you pay it? Is income splitting allowed? This is one of the most important financial and tax decisions you may make. The answer to which is best is subjective, and our CPAs are always available to chat about your specific situation and goals.

For owners of small business corporations making less than $500,000 in Canada, here are some general concepts:

- When the corporation earns profits, the cash belongs to the corp, not the owners. They cannot use those profits for personal spending without first declaring the payment as income.

-

The corporation cannot lend money to the owners without tax consequences. If the owners have drawn cash, borrowed money, or used the corporate bank account for personal expenses during the year, that money needs to be repaid, or taken as a wage or dividend prior to year-end.

- Every business owner needs to be familiar with the rules around personal expenses and business expenses. If the business pays for a personal expense of an owner, it's really like the business paying the owner cash, and then the owner paying for that expense. The payment should be included in the taxable income of the owner.

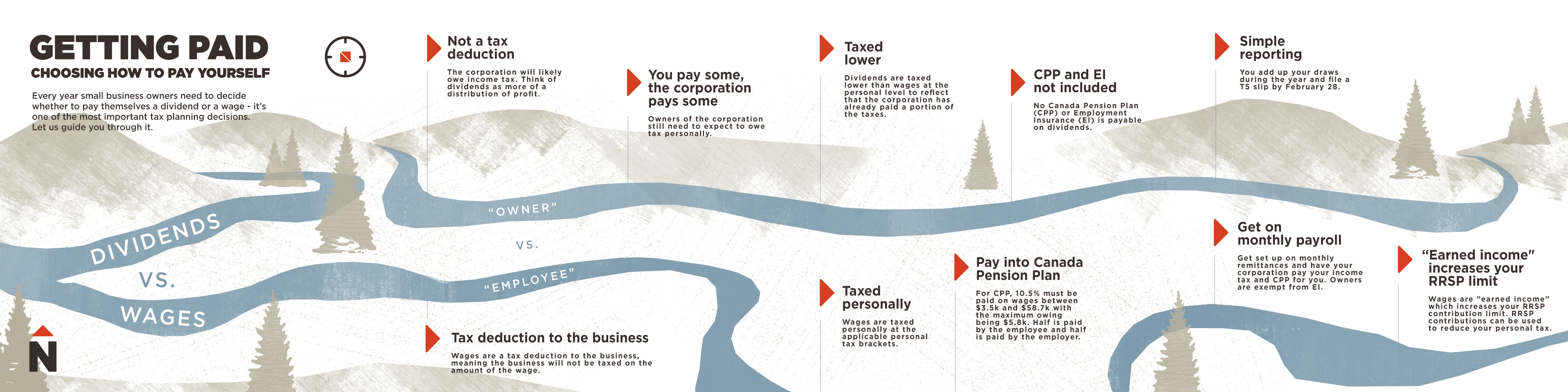

Generally, there are two ways for owners to get paid: dividends and wages (aka salary, bonus, or payroll). Here are the basics of each to help you decide which is right for you.

Paying yourself in dividends

When you pay yourself in dividends, you get paid as a shareholder (or an owner) of the corporation. The corporation issues T5 slips to the owners showing the amount of dividends paid. The figures from the T5 are then used to calculate tax owing on your personal tax return.

- Dividends are not a tax deduction. They are a distribution of profits (usually), which means the corporation likely has taxable income.

- The corporation will pay some of the tax, and the owners will personally pay some of the tax. Owners should expect to owe tax personally.

- Dividends are taxed lower than wages at the personal level to reflect that the corporation has already paid a portion of the taxes. When comparing taxes owing between wages and dividends, be sure to include the corporate tax as well.

- No Canada Pension Plan (CPP) or Employment Insurance (EI) is payable on dividends.

- Dividends do not create RRSP contribution room. Only earned income creates RRSP contribution room.

For simple reporting, add up all the draws during the year and file a T5 slip by February 28.

- Personal taxes on dividends are due to be paid by April 30.

- If your only income at the personal level is dividends, you declare about $20k without paying any tax.

Paying yourself in wages

When you pay yourself in wages, you get paid as an employee of your own business by being put on payroll, or declaring a one-off bonus. The corporation issues a T4 slip showing the amount of wages. These must be filed by February 28.

- Wages are a tax deduction to the business, meaning the business will not be taxed on the amount of the wage.

- Wages are taxed personally at the applicable personal tax brackets. Learn about combined federal and Alberta tax brackets.

- For CPP, 10.5% must be paid on wages between $3,500 and $58,700. Half is paid by the employee and half is paid by the employer. Wages over $58,700 per year are exempt from CPP, so the maximum owing in a year is $5,796, or $2,898 each for the employee and employer.

- Owners are exempt from paying EI premiums.

- Wages are “earned income," which increases your RRSP contribution limit. RRSP contributions can be used to reduce your tax.

Get on payroll and have the company pay the income tax and CPP for you. Monthly payroll remittances are due 15 days after the month when the owner got paid. Generally, total taxes on wages are lower than dividends, but wages tend to be more expensive because of the CPP.

Take advantage of tax deferral

The bulk of tax is paid at the personal level, meaning the real tax benefit to incorporating lies in the ability to defer the personal portion of the tax bill each year. To a certain extent, the owner has the ability to decide how much tax to pay in any given year.

We recommend that you determine your basic living costs, and base your compensation on that. If there is excess cash or profit in the corporation after the owners have been paid, the extra cash can be kept in the corporation. Only corporate tax rates (11%) would apply on that excess.

Income splitting in Canada

The federal government has made some changes to the ability to split dividends between spouses. Rules for dividends now align more meaningfully to the rules around wages – dividends must be earned or must be a reasonable return on investment.

Income splitting in Canada is allowed to the extent that the dividend or wage is reasonable compensation for the effort of the spouse. Or, if the spouse is not involved in the business, the dividend must be compensation for financial risk.

Other ways to be compensated

There are a few one-off ways for owners to take cash from the corporation. These include:

- Shareholder loans: This is only if the owner has lent the company money. The repayment is not income and is tax-free.

- Management fees: If the owner of the corporation is another corporation that provides services, then management fees may be an option.

- Other tax account balances: Capital Dividend Account or Paid Up Capital (PUC)

True North Accounting helps small business owners in Canada with bookkeeping, accounting and tax services. We offer a clear process and an all-in price, upfront. We provide CRA support and vow not to miss a deadline. Our goal is to give entrepreneurs confidence and clarity over their finances.

Our Chartered Professional Accountants (CPAs) can talk you through the pros and cons of wages vs dividends, and calculate your after-tax income under various scenarios to help you determine what’s best for your specific situation. January and February is when we calculate the exact amount of tax owing under dividends, and the exact amount of tax and CPP under wages for our clients. We can also give you the optimal balance of dividends vs salary.

Contact us here or book an appointment now.