With new tax rules put into place for small business, let's take a critical look at whether incorporation is still a good idea.

Read this article to find out:

If you are operating as a sole proprietor, any profits earned from your business are added to any other income you have from other sources thus increasing any taxes owed. If, however, your business operates at a loss, those losses are deducted from any other personal income that you have for that year thus reducing any taxes due.

As such, unless your business is operating at a profit, there is no tax reason to incorporate your business although there may still be a legal or business reason. If you decide to incorporate the biggest benefit is that you will only be taxed on the income you are paid and the corporation pays tax on the excess. This situation is very beneficial due to the tax rate paid by a corporation being 12% on the first $500,000 of profits versus an individual who can pay anywhere from 20% to 49.8%!

Using the example of business income of $150,000, expenses of $50,000 and a person who needs $60,000 per annum of gross wages to live on; the tax savings of operating through a corporation would be almost $12,000 as the business profit of $100,000 would be taxed $40,000 to the corporation and $60,000 to the individual.

Wages are not the only way to pay yourself from your corporation. You can also pay yourself dividends but with the current tax system, you will end up paying $2,185 more in tax than under the wage option for this same $60,000 of personal income.

There are considerations for both the wage and dividend options that include:

Wages

- are an expense to the company

- are subject to CPP contributions which must be paid by the recipient and matched by the company

- are exempt from EI unless you chose to pay into EI specialty benefits

- will generate RRSP contribution room

Dividends

- are paid from after tax corporate income

- can only be paid to shareholders of the company holding shares on which dividends are eligible to be paid and must be for an amount that is reasonable for services performed

- are subject to personal income tax

- are considered investment income for the individual

- are used to calculate the refundable tax portion of any passive income tax paid by a corporation

Costs of Incorporating

Despite these savings, there are costs incurred when incorporating; a lawyer will charge an incorporation fee, and for preparing and filing required regulatory forms. These costs can be upwards of $1,500 for the first year and $500+ a year for future years. Accounting fees are also higher with a corporation so these costs must be weighed against tax savings achieved.

Investment within the Corporation

If funds are saved inside a corporation once taxes are paid on that business income, the remaining cash can be invested into stocks, bonds, term deposits, rental property or any other investment that you could make as an individual with the exception of RRSP’s or TFSA’s. Once the corporate after tax funds are invested; the taxation of the income earned from those investments will be determined by the type of income generated.

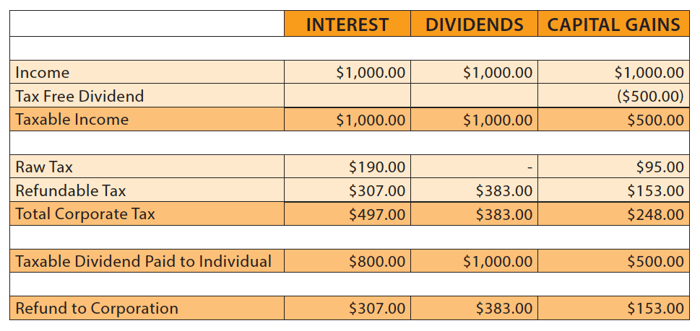

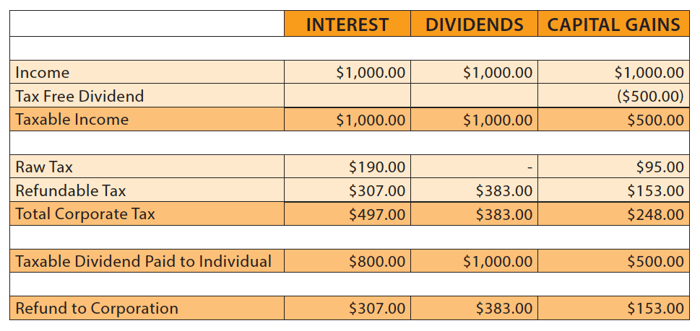

On the income that the company earns from investments the company will be subject to much higher tax, up to 49.7% so why would you leave funds inside a company? Why this still works is that when dividends are paid, some of this high tax is refunded to the company! The refundable amount is linked to the type of investment income earned as follows:

Although at first glance the 49.7% tax rate is usually thought to be ridiculously high, it is actually not as bad as it looks. The tax is split between a raw tax of 19% and a refundable tax of 30.7%. The refundable tax portion must be paid up front to CRA in the year the investment income is earned and sits at CRA until the company pays out a dividend.

When the company pays a dividend out to its shareholders, a refund of this refundable tax is triggered at a ratio of $1.00 for every $3.00 paid out. As such if a dividend of $10,000 is paid out, $3,333 will be refunded out of the refundable tax account, assuming that much refundable tax has been paid to CRA.

New for 2018 is that any investment income earned in excess of $50,000 will result in a reduction of the tax credit that results in a small business paying 12% tax so attention to investment income earned is very important.

Despite this new rule, it still makes sense to keep as much money as possible invested under the corporate name, rather than pulling the funds out personally.

The final reason to still consider incorporating, is that when you are looking into selling your business, there are really only two options – to sell the assets of the business or to sell the shares of company that runs the business. If there is a share sale the biggest advantage is that an individual who sells the shares of their company to an unrelated third party will be able to sell those shares for over $848,000 and not pay a penny of tax. If there is more than one shareholder of the company being sold, each individual shareholder will get their own capital gains exemption of over $848,000.

To summarize the above, if your business makes a profit and that profit is more than what you need to live on, it still makes sense to incorporate your business!

Gabrielle Loren, CPA, CGA is the founding partner of Loren Nancke which has offices in North Vancouver and New Westminster, BC