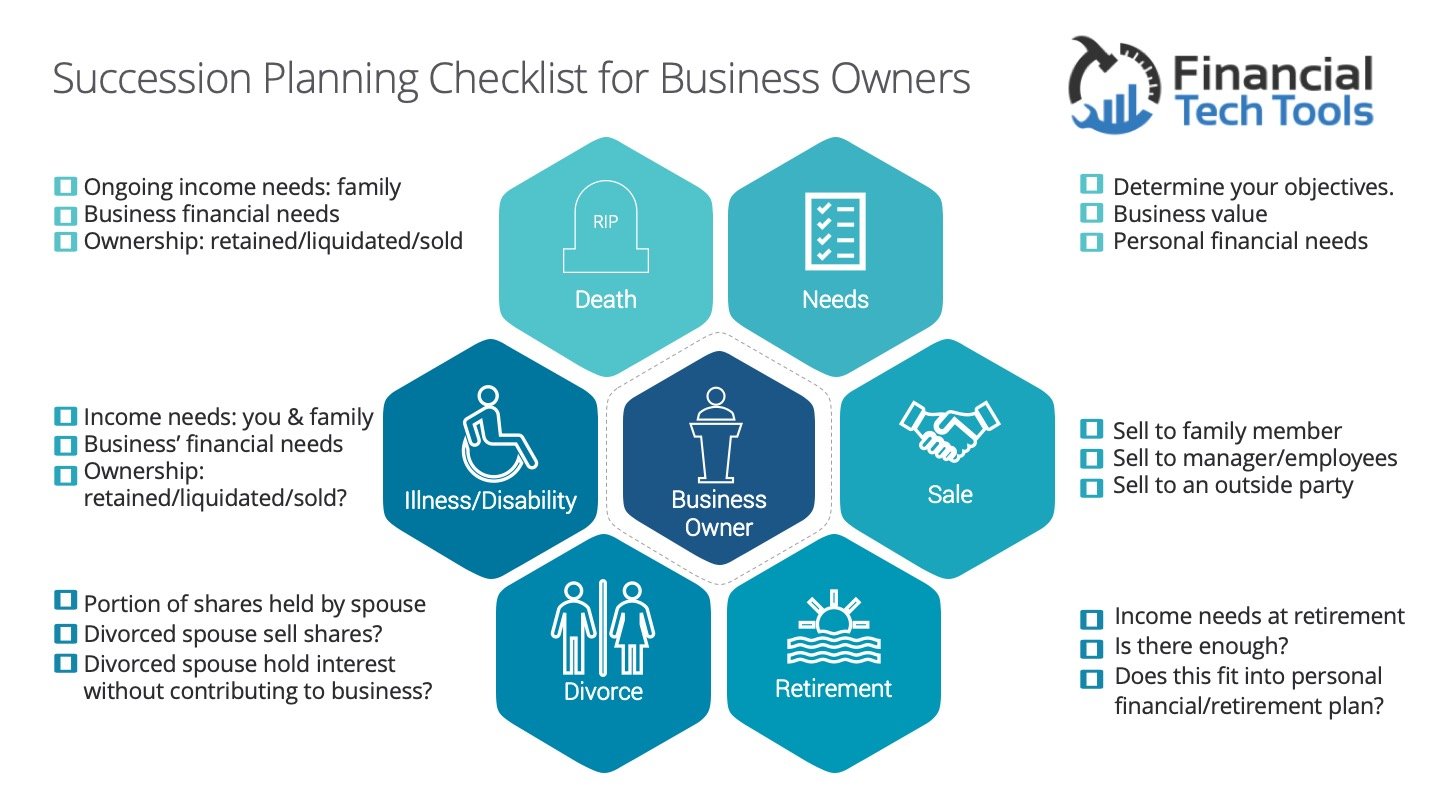

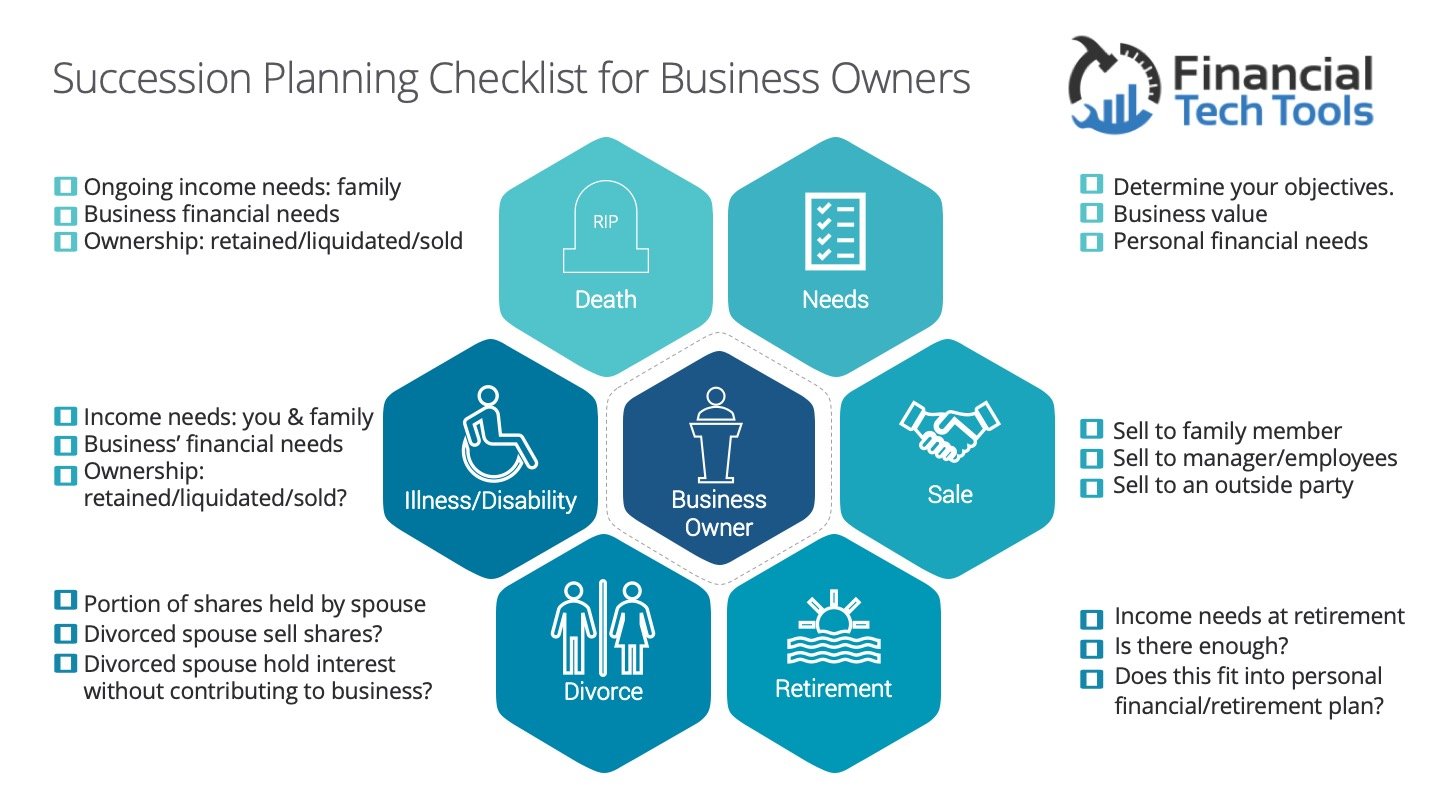

When I put together the Estate Planning for Business Owners checklist, I came to the realization that I had to put together a checklist for Succession Planning for Business Owners (to deal with business assets only.)

Business owners deal with a unique set of challenges. One of these challenges includes succession planning. A succession plan is the process of the transfer of ownership, management and interest of a business. When should a business owner have a succession plan? A succession plan is required through the survival, growth and maturity stage of a business. All business owners, partners and shareholders should have a plan in place during these business stages.

We created this infographic checklist to be used as a guideline highlighting main points to be addressed when you're starting this conversation with a business owner. Keep in mind this is the start of the conversation, each item on the checklist will require an in-depth analysis- often it can take a year to create and implement a plan. The big part of this: WHY. Why have a succession plan? Keep going back to "Why" then you can talk about the "How" and "What" after you've established a solid "Why".

Needs

- Determine the business owner's objectives- what does the business owner want? For themselves, their family and their business. (Business' financial needs)

- What's their share of the business worth? (Business value)

- What are their personal financial needs- ongoing income needs, need for capital (ex. pay off debts, capital gains, equitable estate etc.)

There are 2 sets of events that can trigger a succession plan; controllable and uncontrollable.

Controllable Events

Sale: Who do you sell the business to?

- Family member

- Manager/Employees

- Outside Party

- There are advantages and disadvantages for each- it's important to examine all channels.

Retirement: When do you want to retire?

- What are the financial and psychological needs of the business owner?

- Is there enough? Is there a need for capital to provide for retirement income, redeem or freeze shares?

- Does this fit into personal/retirement plan? Check tax, timing, corporate structures, finances and family dynamics. (if applicable)

Uncontrollable Events

Divorce: A disgruntled spouse can obtain a significant interest in the business.

- What portion of business shares are held by the spouse?

- Will the divorced spouse consider selling their shares?

- What if the divorced spouse continues to hold interest in the business without understanding or contributing to the business?

- If you have other partners/shareholders- would they consider working with your divorced spouse?

Illness/Disability: If you were disabled or critically ill, would your business survive?

- Determine your ongoing income needs for you, your spouse and family. Is there enough? If there is a shortfall, is there an insurance or savings program in place to make up for the shortfall amount?

- Will the ownership interest be retained, liquidated or sold?

- How will the business be affected? Does the business need capital to continue operating or hire a consultant or executive? Will debts be recalled? Does the business have a savings or insurance program in place to address this?

Death: In the case of your premature death, what would happen to your business?

- Determine your ongoing income needs for your dependents. Is there enough? If there is a shortfall, is there an insurance or savings program in place to make up for the shortfall amount?

- Will the ownership interest be retained, liquidated or sold by your estate? Does your will address this? Is your will consistent with your wishes? What about taxes?

- How will the business be affected? Does the business need capital to continue operating or hire a consultant or executive? Will debts be recalled? How will this affect your employees? Does the business have a savings or insurance program in place to address this?

Execution

It's good to go through this with a business owner but you need to help them get a succession plan done. Besides having a succession plan, make sure they have an estate plan and buy-sell/shareholders' agreement.

Because a succession plan is complex, we suggest that a business owner has a professional team to help. The team should include:

- Financial Planner/Advisor (CFP)

- Succession Planning Specialist

- Insurance Specialist

- Lawyer

- Accountant/Tax Specialist

- Chartered Life Underwriter (CLU)

- Chartered Executor Advisor (CEA)

There are definitely unique situations and succession planning can get complicated so please use this when you feel it's applicable.

Financial Tech Tools helps financial advisors grow their business by providing professional websites, calculators and online marketing done by financial industry experts that have their CFP, CLU, CHS and EPC designations. With 25+ years of financial services experience, FinTech speaks "advisor" - talk to them to help grow your business.

To learn more about how Financial Tech Tools can grow an advisory business, please don't hesitate to book a call.