2016 tax season is upon us, and during this time many people often ask, “What are average and marginal tax rates?”

This article will clearly explain the difference and identify a common misconception associated with marginal tax rates.

Your average tax rate is the percentage of your income that went to the government; it’s the total tax you paid divided by your total income. As an example, if you made $10,000 and paid $1,000 in taxes, your average tax rate would be 10%.

Marginal tax rates are little more complicated because Canada uses a progressive tax system. As you make more money, your tax rate increases; in other words, you keep less of each dollar you earn. Your marginal tax rate is the amount of tax you would pay on your next dollar of income.

One of the biggest misconceptions about tax rates is that your entire income will be taxed at your marginal tax rate.

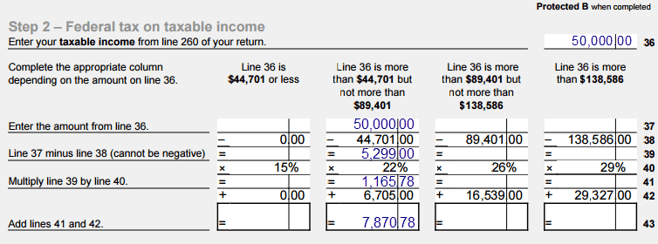

It’s easiest to understand by looking at the federal marginal tax rates on the Schedule 1:

No matter how much money you earn, you only pay 15% tax on your first $44,701 of income1. Then, you pay 22% tax on your next $44,700 of income, up to $89,401; 26% tax on your next $49,185, up to $138,586; and 29% tax on any amount earned over that. This is progressive taxation. As you make more money, you keep less of each dollar.

So, if you earn $50,000, your average federal tax rate is 15.74% ($7,870.78 divided by $50,000) and your marginal tax rate is 22%. If you earned one additional dollar, the federal government would take 22 cents of that dollar.

Don’t forget you also need to layer on provincial taxes. Every province has their own marginal rates and income thresholds.

Knowing your marginal tax rate can help you make effective financial decisions. From a planning point of view it is not good enough to just know how much money you make. It is essential to understand how much you keep. Making a dollar doesn’t allow you to count on spending that dollar. Knowing your marginal tax rate will tell you how much of that dollar you can utilize toward your lifestyle. If you are planning your finances or retirement, the focus should be on your net income.

1You actually pay less than that because your first $11,038 is exempt from tax.

Are you a Small Business Owner in Canada that is interested in saving considerably more on your taxes? Then we encourage you to check out the Olympia Benefits Health Spending Account. Download The Beginner's Guide to Health Spending Accounts to learn more!