Great question, we have debit cards and credit cards, but have you ever thought about what that means? If I have money in my bank account, and I take money out using my bank card, then that is a debit. If I use a credit card, I am getting the bank to lend me the money l until I get my bill; they are crediting me the money.

However in small business accounting, double-entry accounting, the definitions and how credits and debits work is different. Most online accounting software automatically takes care of debits and credits for you so you may never have done a journal entry; but, when you look at the reports, and talk to your accountant or even other small business owners, it will come up and understanding the basics will help you know what is happening in your business.

The Basics of Debits and Credits in Double-Entry Bookkeeping

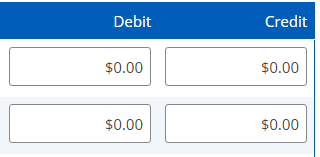

All of your business transactions are tracked as debits and credits (abbreviated as Dr and Cr, respectively) in your account ledger using a T-account. A T-account is a set of records that use double-entry bookkeeping; meaning, debits are recorded on the left-hand side of the "T" and credits on the right-hand side. This is where double-entry bookkeeping gets its name: each transaction requires both a debit and a credit entry in the account ledger.

The source account (the account where the money for the transaction is coming from) is generally credited on the right-hand side, and the destination account (where the money for the transaction is going) is debited on the left-hand side.

For a journal entry in the account ledger to be valid, the total debits must be equal to the total credits. In other words, the total entries on the left-hand side of the T-account must equal the total entries on the right. Sometimes, you will need to use multiple debits and credits for a given transaction for both sides of the journal entry to be equal.

Let’s do a couple of examples so you can see how it works:

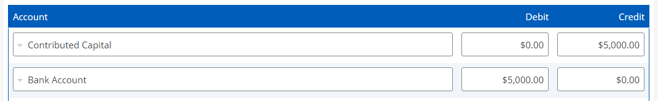

You are just starting up your business, and you need to invest some of your money into your business, this is called Owner's Equity or Contributed Capital. You credit the account the money is coming from, Contributed Capital, and debit the account where the money is going, Bank Account. This is a valid entry as both the Debit and Credit columns are balanced.

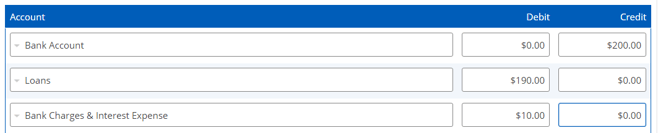

Our next example is slightly more complex as it involves more than two accounts:

You have a bank loan, and your monthly payment is $200; $190 goes to paying off your loan, and $10 goes to servicing the interest on the loan. You credit the account that you are taking money out of, your bank account. Then, you debit the accounts that the money is going to, Loans and Bank Charges & Interest Expense. The key is that the total amount in the Debit and Credit columns must be equal to each other.

Why Does This Matter?

All of your small business accounting reports are based on the transactions that happen in your business, and even if you don’t see the words Debit and Credit when you are inputting the data into your accounting software, they are being used behind the scenes.

When you look at your Trial Balance Report and your Balance Sheet, your accounts will be sorted into Debits and Credits. A trial balance is a standard format used by accountants to prepare financial statements (for example, balance sheets and income statements), which allows you to share the company's financial activities in an easily understood fashion.

How do I make sense of the reports?

There are different types of accounts that you can use:

- Asset

- Liability

- Equity/Capital

- Income/Revenue

- Expense

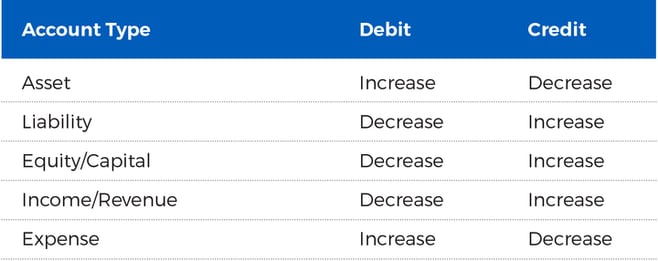

Each of these account types generally sits in a debit balance or a credit balance. Refer to the chart below for the normal state.

Next time you are looking at your accounting reports, you can think back to this chart and think: if your bank account, an asset, has a value in the Debit column that is a good thing because it means that you have money in the bank!