A Health Spending Account is a special account that is established to make medical expenses more affordable for small business owners.

Here’s how the HSA saves the small business owner money.

Keep in mind there are 3 ways for a small business owner to pay for medical expenses.

Let’s take a look at a Health Spending Account vs paying for expenses personally (out of pocket).

1. From personal expense to business expense

A Health Spending Account saves a small business owner money by converting a personal medical expense into a business expense. Keep in mind, the gross income or total cost of a personal medical expense includes the cost of the expense plus income tax.

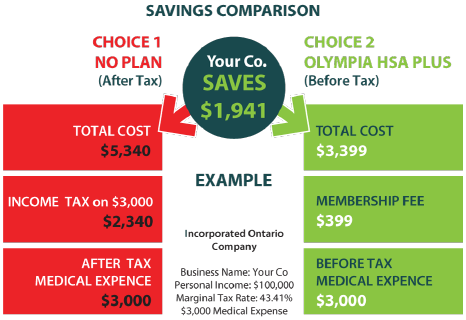

Here’s an example comparing the savings between a paying for an expense personally and through the business.

Choice 1 - Out of pocket: After Tax

The medical expense is paid out of pocket with after tax dollars. The total cost is the gross income required to pay for the medical expense. The business owner would need $1,750 before tax. $750 (43%) is income tax. $1,000 after tax to pay the medical expense.

In other words, for every $1 of medical expense, a gross income of $1.75 is required. $0.75 (43%) is tax.

Choice 2 - Health Spending Account: Before Tax

By using a Health Spending Account, the business owner is able to write off 100% of her dental costs through her corporation. The after tax expense in Choice 1 now becomes a before tax expense. Instead of paying an additional 43% on every dollar she spends on medical expenses, a flat rate annual membership fee is paid to the administrator of her Health Spending Account.

In the example, her company will save approximately 40%. The higher the tax bracket (the top tax bracket in Ontario for 2015 is $49.53%), the more she saves.

Now, let’s take a look at a Health Spending Account vs a traditional insurance plan.

2. From exclusion to freedom

Is there anything more frustrating than being told many of your medical expenses are not eligible? Restrictions on some items and exclusions on others simply mean the business owner has to foot the bill as the insurance company has deemed the service too costly. Moreover, pre-existing conditions and age factors can further reduce your coverage.

Health Spending Accounts have a wide and deep range of eligible medical expenses. With virtually no medical expense being paid out of pocket, a Health Spending Account conserves money by reducing taxes.

3. From premiums to membership

In addition to exclusions, a traditional health and dental plan requires a premium, regardless of your usage. On the flip side, if the plan is used too much, premiums increase.

A Health Spending Account has no premium creep (increase in rates) and gives the small business owner cost control. Instead of a premium, you will pay a low cost membership fee or administration fee.