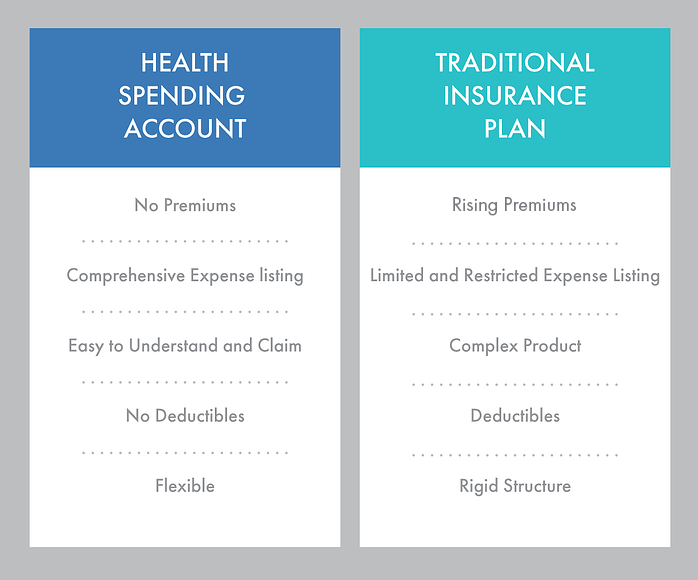

For small business owners, a Health Spending Account is a viable alternative to traditional health insurance. Here's the top 5 reasons to consider purchasing an HSA instead of insurance.

Key Differences between an HSA and insurance:

1. Premiums

Traditional Insurance Plan

- You pay a monthly premium for coverage regardless of access or usage to the plan

- Monthly premium rate often increases at the annual renewal of the policy

- Age of the individual will affect the price of your plan

HSA

- An HSA has no premiums

- Most Health Spending Accounts have a fixed fee as opposed to a premium

- Only pay for the expenses you incur, eliminating a situation where you have paid into a program that you did not use

2. Eligible Expenses and Pre-existing Conditions

Traditional Insurance Plan

- Eligible medical expenses are restricted

- Items that you wish to claim under this policy may be restricted by an annual or life time maximum or require special authorization in order to obtain eligibility

- At time of enrollment, medical history will be requested and pre-existing conditions may be excluded or reduced from coverage

HSA

- Expenses are not restricted by type of expense, only on the dollar amount

- You will have access to a wider range of eligible expenses

- Will not restrict or limit benefits due to a pre-existing medical condition

3. Complexity

Traditional Insurance Plan

- Under a fully insured program, you will receive a plan booklet outlining the items that are covered and also the ones restricted or excluded by definition, co-insurance, deductibles or fee guides. Figuring out what your coverage is and if it will be reimbursed partially or in full can get complicated

HSA

- A Health Spending Account is typically only restricted by dollar amount. You will have 100% coverage for all eligible expenses up to your spending account limit. Your account balance is updated by the administrator every time a claim is processed, eliminating the need to keep track of this information manually

Watch the video below for a full explanation of the difference between an HSA and insurance.

4. Deductibles

Traditional Insurance Plan

- Your benefits may be restricted by an annual single/family deductible

- Benefits can be restricted by a co-insurance of 50%-80%

- There is a limit for the number of visits and treatments

HSA

- No deductible

- You are not restricted by co-insurance

- No limits for the number of visits and treatments

5. Plan Structure

A Health Spending Account is a flexible plan with customization when it comes to limits, classifications, and payment structure. It's easy to use because employees can claim on any eligible expense and never worry about the amount of coverage or restriction on certain expenses. On the contrary, health insurance is often rigid when it comes to payment and coverage.

Health Spending Account Guides:

Download the FREE Complete Guide for a small business with staff:

Download the FREE Complete Guide for a small business with no arm's length employees: