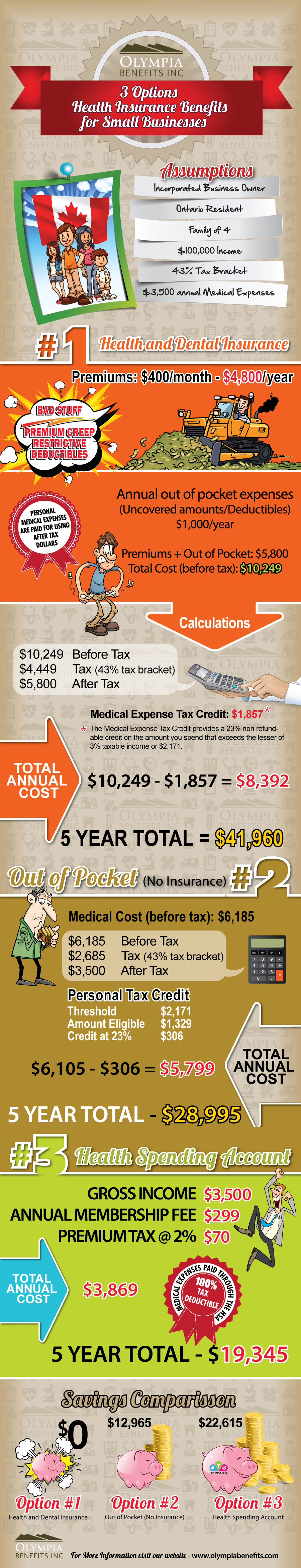

There are 3 options of health insurance benefits for small businesses. You can pick up an insurance plan, pay for medical bills on your own, or use a Health Spending Account.

Here's a cost comparisson betweent the three options.

1. Traditional Health Insurance

Traditional health insurance benefits for small businesses is probably a familiar option. You pay a monthly premium to an insurance company in exchange for health and dental coverage. Typically, the insurance company will earn a margin of approximately 40% on your premiums meaning for every $1,000 in premium you will receive $600 in benefit. In some cases, it can reach as high 65%.

Did you know that many of the events "insured" under a tradtional health insurance plan are actually nothing more than administrative events that don't require insurance? You are essentially paying a 40% markup for a planned, administrative event. It makes sense to insure your home against a fire (an unplanned event). But does it make sense to buy dental insurance when you plan on visiting the dentist twice in the upcoming year? Not to mention the majority of major expenses are paid for by you, out of pocket anyways.

On top of being expensive (deductibles, out of pocket expenses, premium creep), traditional health insurance is riddled with exclusions for pre-existing conditions, complicated claim procedures, and waiting periods.

If you are one person business, traditional health insurance may not be an option as many insurance companies require a minimum of 3 employees in order to qualify for a group plan. Unfortunately, most owner / operator businesses depend on a spousal insurance plan or they pay for their medical bills out of pocket.

2. Pay for medical expenses out of pocket

Considering the expensive and restrictive nature of traditional health insurance, small business owners in Canada often elect to self insure and pay for their medical expenses out of pocket. While this can certainly prove more cost effective than a traditional insurance plan, the cost of paying for medical bills with after tax dollars can be onerous.

Take a look at the total cost of a $1,000 out of pocket medical expense to your small business. Assuming you live in Ontario, earn $100,000 per year, and have a marginal tax rate of 43%, the total cost to your business for a $1,000 medical bill is $1,750. In other words, you would need to earn $1,750 to pay for a $1,000 medical bill because 43% ($750) additional is required to pay income tax. People don't often associate taxes to the true cost of an after tax expense, but at the end of the year, $1,000 is going to cost your business $1,750.

Now, imagine having traditional health and dental insurance for you and your family. The monthly premiums are $350. After 2 years on the plan and $8,400 in premiums later, you discover your teenage daughter requires orthodontics for $6,000 (a modest price). Your Cadillac insurance plan covers $1,500 lifetime for orthodontics. You now have to foot a $4,500 bill AFTER tax. That's a total cost to your business of $7,800 BEFORE TAX. Add up the remaining uncovered portions of your insurance plan, and you can begin to realize the frustration small business owners experience with health insurance.

3. Health Spending Account

Enter the third option. By using a Health Spending Account as a small business owner, you acknowledge several critical facts with health insurance. The first is thatthere is no rational sense in purchasing insurance for a planned event. You understand the majority of listed expenses under a health insurance plan are administrative and planned events. Paying a 40% premium on these events does not make sense.

Second, you realize that exceptional and unplanned events (laser eye surgery, orthodontics, MRI) are for the most part poorly covered by a traditional health insurance plan AND the majority of the cost will come out of your own pocket.

Third, you see that paying for medical expenses of out pocket is not cost effective because you are paying a substantial amount of income tax on these expenses.

Fourth, you understand the cost associated with a catastrophic and life threatening accident will be covered in large part by your provincial plan. If you are concerned about catastrophic drug costs associated with disease, look into a specialized non group drug plan from your province (Alberta Non Group, Trillium Ontario, BC Fair Pharmacare, Saksatchewan Drug Plan, Manitoba Pharmacare)

Given that traditional health insurance is expensive and paying for out of pocket expenses in not cost effective, the optimal solution is to pay for medical expenses through your company with a Health Spending Account.

A Health Spending Account is one of Canada's best kept secrets for small business owners - it converts out of pocket, after tax medical expenses, into a before tax business expense. Since you are going to be self insuring your routine, planned, medical events, why not pay for them in the most cost effective way?

Pricing for a HSA is typically a small annual fee to your administrator or a small administration fee on the amount of your claims. A HSA provides a greater degree of cost control, flexibility, and ease of use.

Are you a small business owner in Canada? Discover a Health Spending Account and learn how to be cost effective with your medical expenses.