There are 2 ways to lower your taxes on prescription eyeglass expenses in Canada. Both methods have their own limitations and eligibility requirements.

Option 1: Medical Expense Tax Credit (METC).

Option 2: Health Spending Account (HSA).

They are not limited to eyeglass expenses only. Any CRA-approved medical expense is eligible.

Option 1: Medical Expense Tax Credit (METC)

Medical expenses can be claimed on your tax return through the Medical Expense Tax Credit (METC).

The Medical Expense Tax Credit is a non-refundable tax credit (cannot bring your taxes owed above 0) which is calculated by taking the lesser of 3% of your net income or $2,352 (2019).

Take the lesser of the 2 numbers and subtract it from your eligible medical expenses. Take the resulting number and multiple it by the lowest marginal tax rate (province + federal). This gives you your Medical Expense Tax Credit amount.

To make the formula easier, we will associate each variable with a letter:

Net Income ($) = A

Eligible Medical Expenses ($) = B

Lowest Provincial Marginal Tax Rate (%) = C

Formula:

Step 1: A * 0.03 = A1

Step 2: Compare A1 with $2,352

Step 3: Take the lower number, we’ll call this A2

Step 4: B – A2 = X

Step 5: X * (C + 0.15) = METC

Note: The 0.15 stands for 15%, which is the lowest marginal tax rate at the federal level.

Note: if the number appears as 0, it means you have not accumulated enough medical expenses to achieve a tax credit.

Option 2: Health Spending Account (HSA)

A Health Spending Account turns your after-tax personal medical expenses into before-tax business deductibles.

By using a Health Spending Account, you can pay for personal medical expenses through your business. You cannot normally expense personal costs through your business. This is the key benefit of a Health Spending Account.

Let's look at a case study to better understand the impact of an HSA on your taxes.

As a business owner, you receive income from your corporation. In Canada, we have a progressive tax structure. Meaning the more income you make, the more the government takes. Your marginal income tax rate will have a significant effect on the total cost of your medical expenses. Your marginal tax rate is the combination of your provincial and federal tax rate.

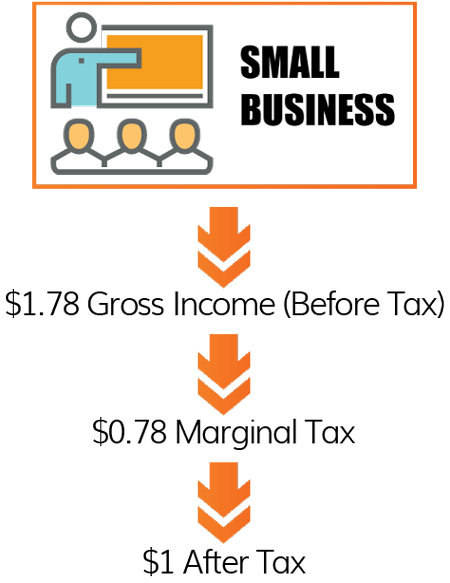

For example: A $100,000 gross income in Alberta would have to earn roughly $1.78 in gross income to bring home $1.00 after-tax. $0.78 of your gross $1.78 (or 43%) would be taxed, leaving you with $1.00 after-tax.

Below is an example of a savings comparison between medical expenses paid personally vs. through your business using a Health Spending Account.

The chart below is for a resident of Ontario.

On the left side (red), you see the true cost to your company when you pay for a $3,000 medical expense personally with after-tax dollars. To get $3,000 personally, you must withdraw $5,340 from your company. $2,340 or approximately 43% (of $5,340) is lost to income tax.

On the right side (green), instead of paying the government 43% tax, you pay Olympia an annual Health Spending Account membership fee of $499. Your company saves almost $2,000 in (marginal income) taxes with a Health Spending Account!

Determine your savings with our Health Spending Account Calculator.

How do I know which option is right for me?

A Health Spending Account is only available to business owners and their employees, and works to eliminate income tax on personal medical expenses. Anyone can apply for the Medical Expense Tax Credit but it only benefits Canadians with high medical bills earning low income. If you are not sure which option is right for you, use the calculators above to see your own savings.

Note: you cannot use both options. This will lead to tax consequences.

Learn more about a Health Spending Account for your small business: