It’s worth taking a look at why your small business should feel confident choosing a Health Spending Account (HSA) to pay for medical expenses.

Here's 5 reasons why a HSA is a better option than a traditional health insurance plan.

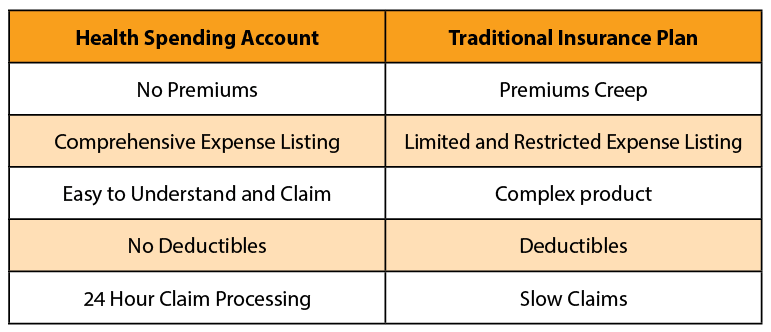

Here is a table to summarize the key differences between a HSA and insurance.

Below, I will expand on each specific point:

1. Premium Creep

Traditional Insurance Plan

- Monthly premium for coverage regardless of access or usage to the plan

- Monthly premium rate often increased at the annual renewal of the policy (premium creep)

- Age of the individual will affect the price of your plan

HSA

- Avoid a premium creep due to usage or age factors

- Most Health Spending Accounts have fixed fee as opposed to a premium

- Pay for the expenses you incur, eliminating a situation where you have paid into a program that you did not use.

2. Eligible Expenses and Pre-Exisiting Conditions

Traditional Insurance Plan

- Eligible medical expenses are restricted

- Items that you wish to claim under this policy may be restricted by an annual or life time maximum or require special authorization in order to obtain eligibility.

- At time of enrollment, medical history will be requested and pre-existing conditions may be excluded or reduced from coverage.

HSA

- Expenses are not restricted by type of expense, only on the dollar amount

- You will have access to a wider range of eligible expenses

- Will not restrict or limit benefits due to a pre-existing medical condition.

3. Complexity

Traditional Insurance Plan

- Under a fully insured program, you will receive a plan booklet outlining the items that are covered and also the ones restricted or excluded by definition, co-insurance, deductibles or fee guides. Figuring out what your coverage is and if it will be reimbursed partially or in full can get complicated.

HSA

- A Health Spending Account is typically only restricted by dollar amount. You will have 100% coverage for all eligible expenses up to your spending account limit. Your account balance is updated by the administrator every time a claim is processed, eliminating the need to keep track of this information manually.

4. Deductibles

Traditional Insurance Plan

- Your benefits may be restricted by an annual single/family deductible

- Benefits can be restricted by a co-insurance of 50%-80%

- There is a limit for the number of visits and treatments.

HSA

- No deductible

- You are not restricted by co-insurance

- No limits for the number of visits and treatments

5. Claims

A Health Spending Account with a digital claim platform will process your claim within 24 hours versus many traditional insurance claims that can take several weeks to process.

A Health Spending Account (HSA) is a tax plan and affordable alternative to traditional health insurance. It turns your after-tax personal expenses into before-tax business deductibles.

To learn whether an HSA is right for you, read our: