Health Spending Accounts are a unique and affordable way for small business owners to reduce the cost of their medical expenses. Despite the plan's proven effectiveness, it could easily be one of Canada's best kept tax secrets.

What is a Health Spending Account (HSA)?

A Health Spending Account (HSA) is also known as a Health Care Spending Account (HCSA) or Private Health Services Plan (PHSP). Accountants may often use any of these terms. To make things easier, I will refer to these plans as a Health Spending Account for the rest of the article.

A Health Spending Account is a cost-effective alternative to traditional health insurance. Health and dental benefits offered through this plan are 100% tax deductible to the employer and received 100% tax free by the employee. There are no premiums, hidden fees, deductibles, copay, or complex policies.

How does a Health Spending Account work?

A Health Spending Account can be viewed from two different perspectives: as a small business owner with staff (arm’s length employees) where you are providing an employee benefit or as an incorporated individual where you are paying for your personal medical expenses. See below for an explanation of each perspective.

HSA as an Employee Benefit

Are you a small business owner with staff? A Health Spending Account makes for a great employee benefits package. It is a cost effective and flexible alternative to traditional health insurance. Employers get value from an HSA as they get cost control with their benefits (there are no premiums with an HSA). Moreover, an HSA is easy to implement, manage, and the plan is customizable. Employees prefer an HSA as it is a tax free benefit, coverage is complete, and the benefit is flexible.

Here are additional details on how an HSA works:

Download your free Complete Employee Benefits Guide

HSA for a One Person Corporation

Are you an incorporated individual? A Health Spending Account turns your after-tax personal medical expenses into a before-tax business deduction.

Basically, you get to withdraw money from your corporation tax free to pay for your personal medical expenses.

It is easiest to understand the cost-savings of a HSA by a case study:

As a business owner, you receive income from your corporation. In Canada, we have a progressive tax structure. Meaning the more income you make, the more the government takes. Your income tax rate will have a significant effect on the total cost of your medical expenses. Your marginal tax rate is the combination of your provincial and federal tax rate.

For example: if you earn $100,000 in Alberta, your marginal tax rate is 36%. You would have to gross roughly $1.60 to bring home $1.00 after-tax. $0.60 of your gross $1.60 (or 36%) would be taxed, leaving you with $1.00 after-tax. Keep in mind, medical expenses are an after tax event.

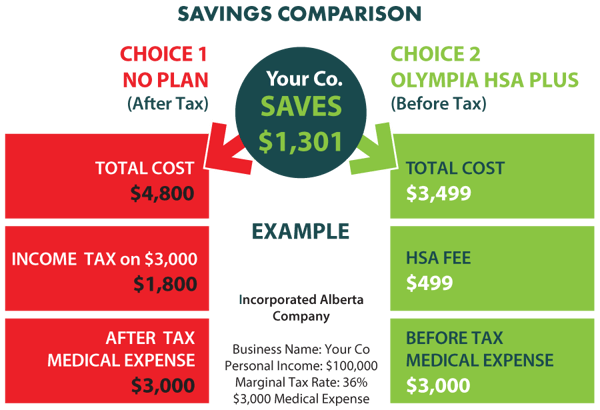

Below is an example of a savings comparison between paying for a medical expense with no HSA (red) vs. through your business using an HSA (green).

On the bottom left (red), you see the total cost to your company when you pay for a $3,000 medical expense with no HSA. To get $3,000 after tax to pay for your medical expense, you must withdraw a gross amount of $4,800 from your company. $1,800 or approximately 36% (of $4,800) is paid in income tax.

On the right side (green), instead of paying the government 36% income tax, you pay Olympia an annual HSA membership fee of $499. Your company saves over $1,000 in taxes by using an HSA. You can find out exactly how much you will save by using our HSA savings calculator.

Watch the video below to see how an HSA works for an incorporated individual.

The Key Takeaway for a Small Business

Health Spending Accounts are used by companies across Canada to to control their medical costs and receive more flexible coverage than a traditional health insurance plan. If you have medical expenses, then this plan will save money for you.