Every dental insurance plan is different - we're talking about a wide range of deductibles, premiums, restrictions, etc. However, they all have one thing in common - they are asking you to insure something that is not necessary. Let me explain, the concept of "insurance" is to reduce your risk by being pooled in the event of a catastrophic financial or medical event. Insurance is not necessary for routine maintenance events like dental. Especially in Canada, where the public healthcare system will take care of emergency medical events.

Why is private health insurance not necessary for planned, non-catastrophic events?

An example of a planned, non-catastrophic event is your routine dental appointment. Most people schedule a teeth cleaning at least once a year. It is non-catastrophic because there is no financial or health risk involved. Most health and dental costs typically fall under planned routine events.

Why is insurance not needed for these events? Well, let’s think about the definition of insurance. The purpose of insurance is to transfer individual risk away, into a collective pool, effectively nullifying the risk. In the case of insurance, it means paying a fee to an insurer, which keeps you within the collective pool.

Back to the example: there is little risk involved with a dental appointment. Furthermore, it is planned ahead of time. There is no point to insuring low risk, non-catastrophic, planned events. You are better off paying the costs upfront.

When do you need insurance?

Insurance is reserved for unplanned events that possess a low probability of occurring but a high consequence or cost. Consider your home burning down: it's relatively unlikely to occur, but if it does, there is a tremendous cost associated with the event. In this example, insurance is a must-have.

What if I received an unplanned, catastrophic dental cost?

As the name suggests, maintenance events like your dental appointments are routine and expected. If you are going to your dentist on a regular basis (once or twice a year), then the medical professional will be able to check up on your diet, hygiene, and general health consistently. You should never be blindsided by a sudden expense that you wouldn't already expect. You are much better off claiming these medical expenses through a Health Spending Account (HSA) and saving up an emergency fund inside of a savings account instead of paying monthly unrecoverable premiums on a health insurance plan that wouldn't even cover 100% of your dental costs.

When is something not insurable?

Events that are classified as having a high probability and high cost are generally not insurable by insurance companies (or at least require very expensive premiums) as these present significant risk. An example of this type of scenario may be a person that wishes to build a house in a known flood plain. Insurance companies are likely to view the probability of a flood occurring and the associated cost of resulting damage as too high, making it therefore impossible for this person to obtain flood insurance.

Going Full Circle - when you don't need insurance

Regular health and dental expenses not covered by provincial healthcare. This includes such events as a teeth cleaning, obtaining prescriptions and vision checkups.

The probability of these types of events occurring for the average person is likely to be moderate-to-high, but the cost of such occurrences are considered to be relatively low. Remember that insurance, as defined above, is designed to protect you against the risks of the unknown. Yet, these regular health and dental expenses are generally expected. So why is health and dental insurance actually considered to be "insurance"?

If one examines the premiums paid by an average small business for this type of "insurance," one will find that the costs of the coverage outweighs the out-of-pocket costs of paying for these expenses by oneself.

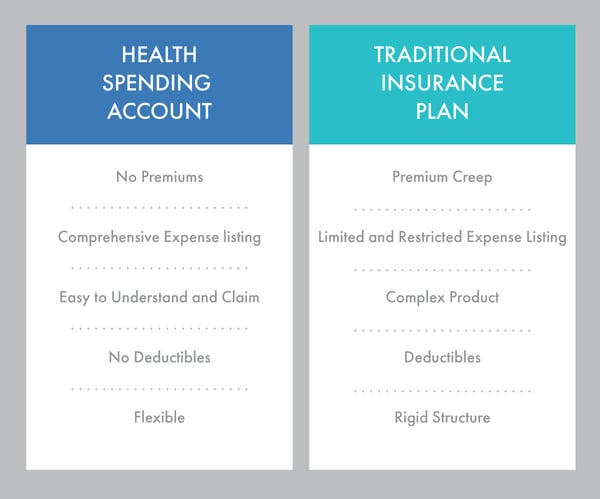

Keep in mind that most traditional plans don't even pay for the entire amount of typical additional health and dental expenses (this is known as "co-pay"). In addition, these plans generally possess severe restrictions or simply don't cover every form of moderate-to-major type of expense, such as laser eye surgery and orthodontics.

What are alternatives to insurance for a small business owner?

There is a viable alternative to cover health and dental expenses.

A Health Spending Account (HSA) is the best-kept tax secret for Canadian small business owners. It works by eliminating the tax on all your medical expenses and is 100% compliant with CRA guidelines. Through the HSA, health and dental benefits are fully tax deductible to the business and received 100% tax free by the employees. Eligible expenses can range from a new pair of prescription sunglasses to massages to a visit to the dentist. HSA plans provide flexibility for employees and cost savings for employers. It has no premiums, deductibles, copay, or complex terms.

What are the benefits of a Health Spending Account?

There are many to name, but here are some of the strong points for a small business with employees:

- Ease of use when it comes to setting up and using the plan from both an employee and employer perspective.

- The employee won’t have to look through documents to understand their coverage and deductibles. They simply receive a limit and get reimbursed 100% tax free on medical costs.

- The employer will only have to spend when an employee claims… unlike insurance, where money is lost to an unrecoverable premium even if employees do not claim.

Discover the better way to save costs on medical expenses in Canada:

Download the FREE Guide for a Small Business with Employees