Updated: January 2020

Insurance protects you against the risk of the unknown. You don't even consider foregoing homeowner's or auto insurance. Similarly, if you are a farmer on the Prairies, you're likely going to have hail insurance. Insurance is there to help you if you can't afford to pay out of your pocket to set right something that has gone wrong, like a car accident, a tree in your yard falling on a neighbor's house, or the death of a spouse. Essentially, an unplanned catastrophe.

When should you buy insurance?

In essence, insurance is generally reserved for unforeseen events that possess a low probability of occurring along with a high cost if experienced. Consider your home burning down: it's relatively unlikely to occur, but if it does, there is a tremendous cost associated with the event. In this example, insurance is a must-have.

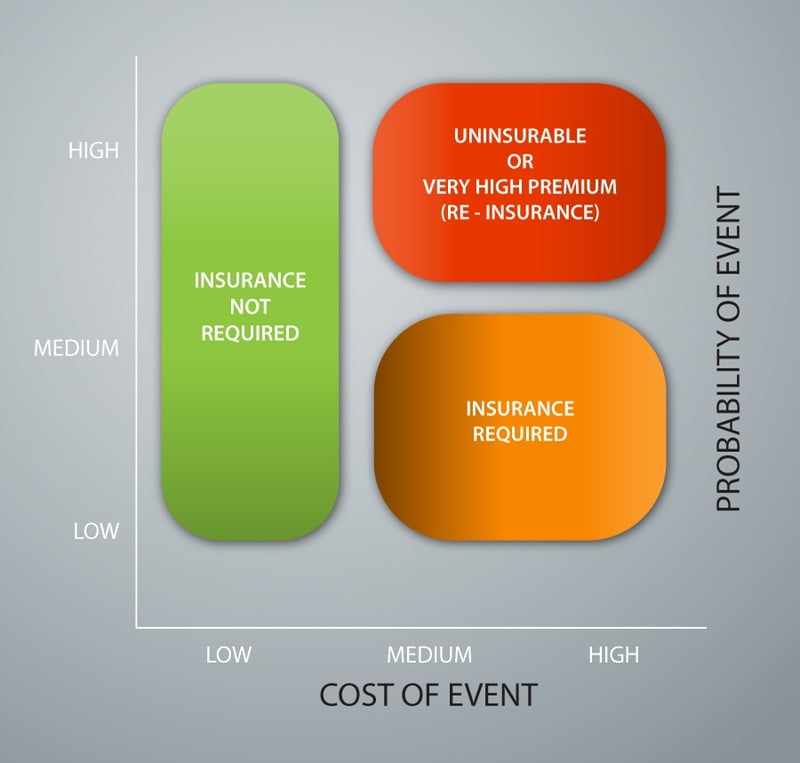

Now let's turn our attention to the chart labeled Figure 1.0, below. On the Y-axis is the probability of any particular event occurring, ranging from "low" to "high". The X-axis represents a continuum of the cost of an event occurring, also ranging from "low" to "high".

FIGURE 1.0

EVENT PROBABILITY VS. COST OUTCOMES

For example, an event such as one's home burning down would be located in the bottom right hand corner, as it is typically classified as "Low Probability" and "High Cost". This area of the graph is clearly classified as "Requiring Insurance".

When is something not insurable? (High Cost - High Probability)

In addition, events that are classified as having a high probability and high cost are generally not insurable by insurance companies (or at least require very expensive premiums) as these present significant risk. This is represented by the top right hand corner of the graph. An example of this type of scenario may be a person that wishes to build a house in a known flood plain. Insurance companies are likely to view the probability of a flood occurring and the associated cost of resulting damage as too high, making it therefore impossible for this person to obtain flood insurance.

When is insurance not required? (Relatively Low Cost - Moderate to High Probability)

Now consider regular health and dental expenses not covered by provincial healthcare. This includes such events as a teeth cleaning, obtaining prescriptions and vision checkups. The probability of these types of events occurring for the average person is likely to be moderate-to-high, but the cost of such occurrences are considered to be relatively low.

And remember that insurance, as defined above, is designed to protect you against the risks of the unknown. Yet, these regular health and dental expenses are generally expected. So why is health and dental insurance actually considered to be "insurance"?

This is a fundamental question that is not actively considered by many Canadians; rather, big insurance companies market the message that small-to-medium sized businesses should purchase traditional insurance plans in order to responsibly "cover" these types of costs.

Yet, this is simply not the case. In fact, if one examines the premiums paid by an average small business for this type of "insurance," one will find that the costs of the coverage outweighs the out-of-pocket costs of paying for these expenses by oneself.

Keep in mind that most traditional plans don't even pay for the entire amount of typical additional health and dental expenses (this is known as "co-pay"). In addition, these plans generally possess severe restrictions or simply don't cover every form of moderate-to-major type of expense, such as laser eye surgery and orthodontics.

The fact of the matter is that traditional insurance for small-to-medium business owners is not generally required for these types of "minor" events, as outlined in Figure 1.0. A person is better off financially to simply pay out-of-pocket for additional health and dental expenses.

If I don't use insurance, is there a way to save costs on my medical expenses in Canada?

Paying for your medical expenses out-of-pocket is using your after-tax dollars. That's why there is a more efficient and cost-effective method available to incorporated businesses to pay for all health and dental related expenses using pre-tax dollars. This tax plan is called a Health Spending Account. It is an alternative to health and dental insurance which allows business owners to pay for 100% of their medical expenses with before-tax money (through their own business).

Want to learn more about Health Spending Accounts?

Download the Beginner's Guide to Health Spending Accounts for a business with employees:

Or, if you own a corporation with no employees (except yourself and / or a spouse), download The Beginner's Guide to Health Spending Accounts for a small business with no employees:

Related Reading:

Is Private Health Insurance Worth It in Canada?

5 Reasons a Health Spending Account is better than health insurance

How does a Health Spending Account work in Canada?