Health insurance is it worth it?

The answer is... no (in most cases). Private health insurance in Canada is costly and ineffective for its intended purposes. There are five reasons why it shouldn't be used, from a business owner and employee perspective.

Reason #1 - Private health insurance is not needed for planned, non-catastrophic events

An example of a planned, non-catastrophic event is your routine dental appointment. It is planned because most people schedule a teeth cleaning at least once a year. It is non-catastrophic because there is no severe risk involved. Most health and dental costs typically fall under this category.

Why is insurance not needed for these events? Let’s think about the definition of insurance. The purpose of insurance is to transfer individual risk away, into a collective pool, effectively nullifying the risk. In the case of insurance, it means paying a fee to an insurer, which keeps you within the collective pool.

Back to the example: there is little risk involved with a dental appointment. Furthermore, it is planned ahead of time. There is no point to insuring low risk, non-catastrophic, planned events. You are better off paying the costs upfront.

Now, you might ask whether there are other forms of insurance that are useful. The answer to that is yes, there are other types of insurance that are effective and necessary, such as car insurance or house insurance. On the small chance that your house burns down, then you will be covered. You need this insurance because you may not be able to afford the consequences.

But let’s cover all sides of the argument. Some people may have a tooth decay, which is unplanned. Well, there’s two reasons why health insurance still isn’t needed. First, it is a non-catastrophic event, so there’s no need to transfer away the risk. Secondly, most insurers will not cover this procedure anyway.

Reason #2 - Private health insurance brings no value in exchange for its cost.

Over the years, insurance companies have marketed their plans over mainstream media, to encourage generation over generation that an insurance plan is necessary. This is not true. In most cases, you will save more money by paying for your medical costs upfront (out of pocket). There are more effective ways to save (we’ll talk about this in the last section).

Most insurance companies aim for a 60/40 split. This means that insurance only returns about $0.60 for every $1.00 in a premium paid, to the employees for their claimed health and dental benefits. The resulting $0.40 of each dollar paid in a premium covers costs to administer the plan. In other words, profit for the insurer.

Related Reading: Do I Need Private Health Insurance in Canada? [The Truth for Small Business Owners]

Reason #3 - Private health insurance has limited plan flexibility

With millennials entering the workforce and global borders opening, the workforce is becoming more and more diverse. What this means for employers is a workforce with differing needs and values. In order to combat this change, benefits should be flexible. In most cases, an insurance plan comes with limited coverage, few eligible expenses, and many restrictions. When one employee claims more than the others, the collective team suffers from increasing premiums so that insurers can maintain the aforementioned 60/40 loss ratio.

Reason #4 - Private health insurance is complex and hard to use

If you have ever tried setting up an insurance plan, you will know that there are many terms and variables which will confuse employees more than it benefits them. You are faced with fees like premiums, deductibles, copay, coinsurance and more. These apply at different times and reduce the amount of money that actually goes back to the employees. Additionally, your plan may not cover pre-existing conditions (ex. diabetic), in which case, those employees may be excluded from the plan. In some cases, the insurer might outright refuse coverage for the entire company.

Reason #5 - There is an effective and affordable alternative to health insurance

There is a viable alternative to cover health and dental expenses.

Behold... a Health Spending Account (HSA) is the best-kept tax secret for Canadian small business owners. It works by eliminating the tax on all your medical expenses and is 100% compliant with CRA guidelines. Through an HSA, employers can designate custom allotted allowances to their employees. Employees can use these 100% tax free funds on any health-related (eligible) expense. That can range from a new pair of prescription sunglasses to massages to a visit to the dentist. An HSA plan provides flexibility for employees and cost savings for employers. It has no premiums, deductibles, copay, or complex terms. Pricing is simple. To learn more, check out our Beginner’s Guide to a Health Spending Account.

When should you buy insurance? (Low Probability - High Cost)

In essence, insurance is generally reserved for unforeseen events that possess a low probability of occurring along with a high cost if experienced. Consider your home burning down: it's relatively unlikely to occur, but if it does, there is a tremendous cost associated with the event. In this example, insurance is a must-have.

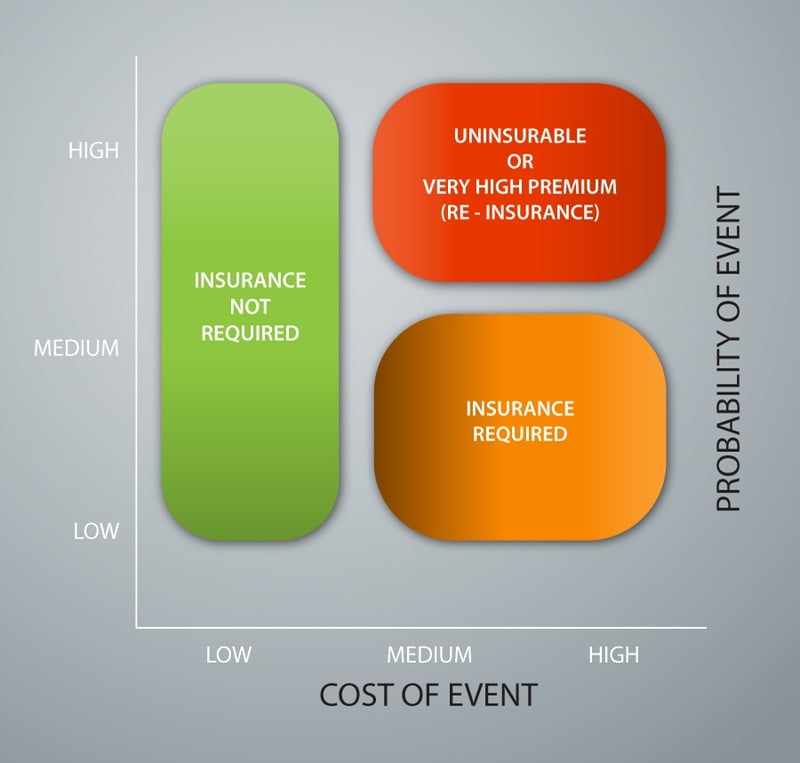

Now let's turn our attention to the chart labeled Figure 1.0, below. On the Y-axis is the probability of any particular event occurring, ranging from "low" to "high". The X-axis represents a continuum of the cost of an event occurring, also ranging from "low" to "high".

FIGURE 1.0

EVENT PROBABILITY VS. COST OUTCOMES

For example, an event such as one's home burning down would be located in the bottom right hand corner, as it is typically classified as "Low Probability" and "High Cost". This area of the graph is clearly classified as "Requiring Insurance".

When is something not insurable? (High Cost - High Probability)

In addition, events that are classified as having a high probability and high cost are generally not insurable by insurance companies (or at least require very expensive premiums) as these present significant risk. This is represented by the top right hand corner of the graph. An example of this type of scenario may be a person that wishes to build a house in a known flood plain. Insurance companies are likely to view the probability of a flood occurring and the associated cost of resulting damage as too high, making it therefore impossible for this person to obtain flood insurance.

When is insurance not required? (Relatively Low Cost - Moderate to High Probability)

Now consider regular health and dental expenses not covered by provincial healthcare. This includes such events as a teeth cleaning, obtaining prescriptions and vision checkups.

The probability of these types of events occurring for the average person is likely to be moderate-to-high, but the cost of such occurrences are considered to be relatively low. Remember that insurance, as defined above, is designed to protect you against the risks of the unknown. Yet, these regular health and dental expenses are generally expected. So why is health and dental insurance actually considered to be "insurance"?

This is a fundamental question that is not actively considered by many Canadians; rather, big insurance companies market the message that small-to-medium sized businesses should purchase traditional insurance plans in order to responsibly "cover" these types of costs.

Yet, this is simply not the case. In fact, if one examines the premiums paid by an average small business for this type of "insurance," one will find that the costs of the coverage outweighs the out-of-pocket costs of paying for these expenses by oneself.

Keep in mind that most traditional plans don't even pay for the entire amount of typical additional health and dental expenses (this is known as "co-pay"). In addition, these plans generally possess severe restrictions or simply don't cover every form of moderate-to-major type of expense, such as laser eye surgery and orthodontics.

The fact of the matter is that traditional insurance for small-to-medium business owners is not generally required for these types of "minor" events, as outlined in Figure 1.0. A person is better off financially to simply pay out-of-pocket for additional health and dental expenses.

Discover the better way to save costs on medical expenses:

Paying for your medical expenses out-of-pocket is using your after-tax dollars. That's why there is a more efficient and cost-effective method available to incorporated businesses to pay for all health and dental related expenses using pre-tax dollars. This tax plan is called a Health Spending Account. It is an alternative to health insurance which allows business owners to pay for 100% of their medical expenses with before-tax dollars.

Download the Free Guide for a Small Business with Employees: