The Health Spending Account is a tax tool that allows you to pay for 100% of your medical expenses through your business (as opposed to paying for them personally). This means you and your company can save a lot of money by reducing your taxes.

This article will cover exactly how a Health Spending Account (HSA) works for an incorporated professional.

What is a Health Spending Account?

At it's core, the HSA is a contract between your corporation and yourself. The contract is based on CRA guidelines that allow your corporation to reimburse you for out-of pocket medical expenses. The reimbursements are 100% tax free to you and 100% tax deductible for your company. Basically, you get to withdraw money from your company without having to pay income tax.

Now, let’s find out exactly how an HSA saves you money on your medical expenses through a case study:

Case Study Profile

This article assumes the following conditions:

1. You own a corporation with no employees other than yourself and your spouse.

2. You have 2 dependent children.

3. As a family, each member will require about $900 per year (or $3,000 as a family) to maintain your health. We did an analysis of over 1 million claims and also looked at Statistics Canada to determine this number. In some years, this number can be much higher (if you get braces or laser eye surgery) but over an average number of years, the approximate out of pocket total will be $3,000 per year.

4. It is fine if you do not have a spouse, or dependent children. Subtract or add $900 for each dependant.

5. You earn between $90,000 and $140,000.

Want to find out your own HSA tax savings? Try the Olympia HSA Savings Calculator.

How can I pay for medical expenses?

You have three options to pay for your medical expenses:

1. Traditional health insurance

You pay a monthly or quarterly premium in exchange for coverage. Quite often this

option results in a feeling of “not enough coverage for what I’m paying for”. There are many exclusions, especially with dental and vision. Insurance can be complex, costly, and restrictive.

2. No insurance / out-of-pocket

Many small business owners don’t have health insurance because it’s too expensive and the coverage is poor. This means they have no plan and they pay for their medical expenses “out of pocket”. Don’t feel bad if your in this situation – it’s actually more cost effective than having insurance.

3. Health Spending Account

The cost effective alternative to insurance and paying for medical expenses out of

pocket. It turns 100% of after tax medical expenses into before tax business deductions.

Watch the video below for a quick explanation of a Health Spending Account.

What is the true cost of a medical expense?

It is important to realize that medical expenses are a personal expense (we could be talking about the premiums your spouse pays for an insurance plan or out of pocket dental costs, etc). Another term for personal expense is after-tax expense.

Therefore, to understand the true cost of your medical expenses, you need to understand the impact of taxes (before tax vs. after tax).

How do taxes impact the cost of my medical expenses?

As a business owner, you receive income from your corporation. In Canada, we have a progressive tax structure. Meaning the more income you make, the more the government takes. Your marginal income tax rate will have a significant effect on the total cost of your medical expenses. Your marginal tax rate is the combination of your provincial tax rate and the federal rate.

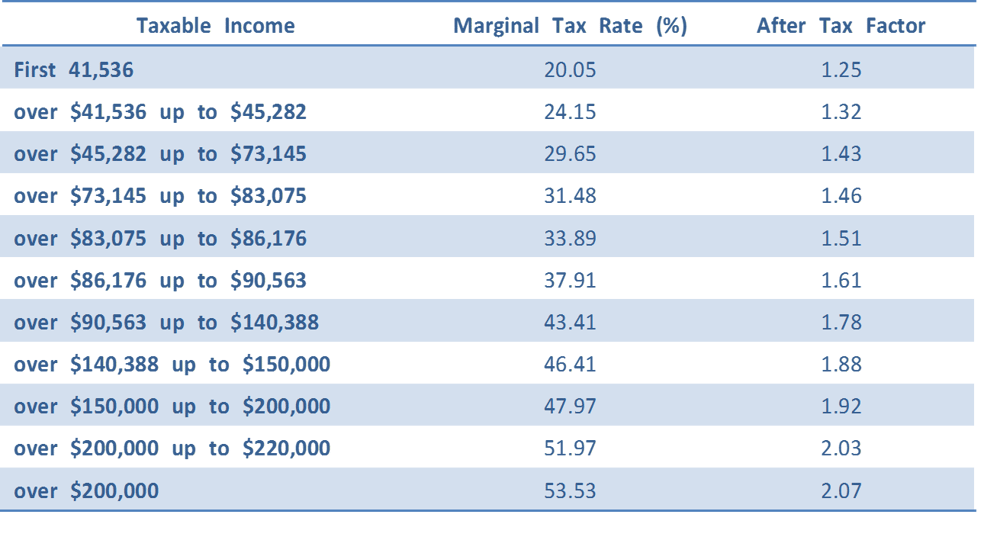

In the below table, you can see the different tax rates for increasing levels of T4 income in Ontario. The “After Tax Factor” column on the right is the gross amount you must earn to bring home $1.00 after-tax for that particular tax bracket.

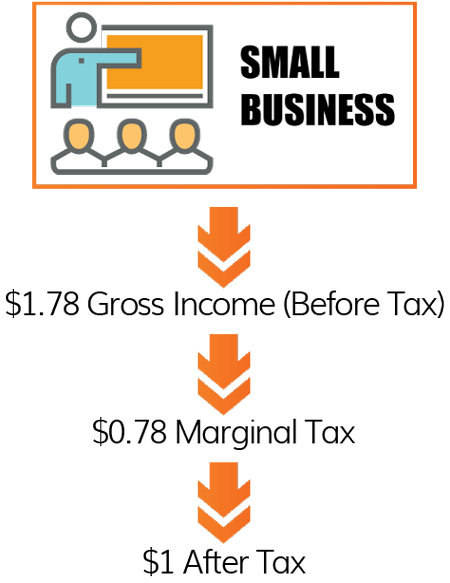

For example, if you earn $100,000, you would have to gross $1.78 to bring home $1.00 after-tax. $0.78 cents of your gross $1.78 (or 43%) would be taxed leaving you with $1.00 after tax.

The diagram above illustrates the before and after tax concept. If you earn $100,000 and have a marginal tax rate of 43%, you will have to gross $1.78 to get $1 in your pocket.

How much would it cost you to have health insurance?

For a family of 4, your monthly premiums for health and dental insurance would be about $400 per month. That’s $4,800 per year. We can assume you will have deductibles of approximately $1,000 on top of your premiums.

The cost of the yearly premiums and deductibles would be $5,800. The $5,800 is a personal medical expense.

The total cost to your business, including taxes, is $10,300.

Remember back to the table above? With gross income of $10,300, you pay tax of $4,500 (or 43% tax rate). This leaves you with $5,800 after-tax.

How much would it cost you to pay your medical expenses with no insurance?

At the beginning of the article, we assumed your family of 4 needs $3,000 per year to maintain its health.

Your total cost to pay for $3,000 in medical expenses would be $5,340.

Again, $5,340 gross income taxed at 43% would leave you with $3,000 after tax.

How much would it cost you to pay your medical expenses through an HSA?

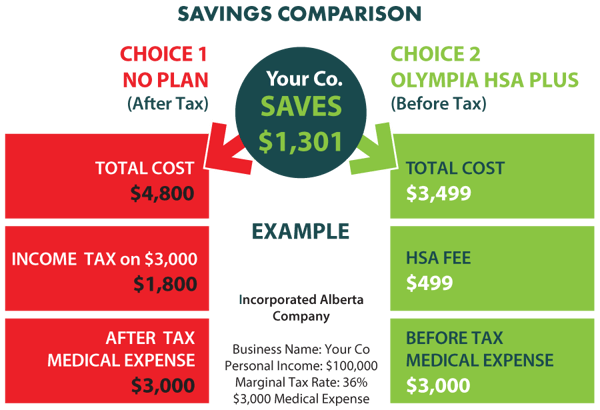

On the left, you can see the true cost ($4,800) to your company when you pay for a $3,000 medical expense personally with after-tax dollars.

On the right, you can see that instead of paying the government 36% tax, you pay Olympia an annual HSA membership fee of $499.

With an HSA, you only pay $3,499 in costs. Your company saves almost $2,000 in taxes!

What can I claim with a Health Spending Account?

You can claim virtually all medical expenses. If there a reasonable health need for the medical expense, then it can be claimed. A complete list can be found here.

How does a HSA claim work?

Let’s see how you would pay for a $3,000 medical expense.

Step 1 - Pay for the $3,000 medical expense on your personal credit card.

Step 2 – Login to your HSA account with Olympia and submit the details of

your receipt online. You hold on to the original.

Step 3 - Send a payment online to Olympia from your business bank account

for $3,000.

Step 4 - Olympia reimburses you personally for your original personal

expense. A direct deposit of $3,000 will be made to your personal

bank account.

The $3,000 payment from your corporation is tax deductible.

The $3,000 reimbursement is tax-free.

Am I paying for the expense twice?

Remember at the beginning, we defined the HSA as a contract between your corporation and yourself. The contract states your corporation will reimburse you for your out of pocket medical expenses.

Each step in the claim process is necessary to fulfill the conditions of that contract. Steps 1 and 2 are your personal requirements or out of pocket medical expenses. Step 3 fulfills your corporation’s requirement to fund the HSA. This payment creates the tax deduction for your company. Step 4 is the tax-free reimbursement for your out of pocket medical expense.

The net cost of the 4 step process is $3,000 to your business. Keep in mind, that’s far better than the amount it would cost your business if you had to pay taxes on the $3,000.

Let’s say in 2016 you had no HSA, $3,000 in medical expenses, and an income of $100,000. In 2017, you decide to run the $3,000 through an HSA. You will now only pay income tax on $97,000 instead of $100,000. The $3,000 is not part of your taxable income!

Do I qualify?

To qualify you must:

- own a corporation

- pay income tax

- have medical expenses.

Olympia HSA Plan Options

There are three different HSA Plan options for a single person business (with or without spouse):

Olympia HSA BASIC is a Health Spending Account with no setup or administration fees.

Olympia HSA PLUS is a benefits package containing:

- A Health Spending Account with no set up fees, no administration fees.

- Three insurance plans: medical travel insurance plan, emergency medical insurance plan, and catastrophic drug insurance plan.

The (3) Insurance Plans:

Travel Medical Insurance

• Coverage per trip of up to 45 days

• Up to $2,000,000 of coverage

• Coverage up to and including age 69

• Single and family coverage (for employees, spouses of any age and/or dependent children)

• No deductible

• No pre-existing condition clause up to age 65

Emergency Medical Insurance

• Semi-Private Hospital $5,000 per covered person per year

• Ground Ambulance $5,000 per covered person per year

• Accidental Dental $5,000 per covered person per year

• Home Care Nursing $10,000 per covered person per year

• Convalescent Home Care $10,000 per covered person per year

• Ambulatory/Mobility $5,000 per covered person per year

• Assistive Devices

Catastrophic Drug Insurance

• Single and Family coverage

• No Medical Underwriting

• $2,500 deductible

• $25,000 per person/per year

• $100,000 lifetime maximum

• Coverage up to and including age 69

Olympia HSA DELUXE is a benefits package containing:

- A Health Spending Account with no set up fees, no administration fees.

- Three bonus insurance plans: medical travel insurance plan, emergency medical insurance plan, and catastrophic drug insurance plan.

- Dialogue Telemedicine services - on-demand, virtual healthcare for you and your family.

The Dialogue Telemedicine Services:

- Chat with a nurse, doctor, or nurse practitioner within minutes

- Video consultation with health care professional for diagnosis

- Prescriptions and renewals available

- Referrals to specialists

- Free delivery of medication

- Continuity of care / follow ups with the same professional

- Concierge services and follow ups

- Proprietary full-stack technology

The (3) Insurance Plans are the same as the ones in the HSA PLUS plan above.

What’s next?

You can sign up for an HSA through our website in under 5 minutes.

Not ready to sign up for an Olympia HSA yet? Take a look at our in-depth HSA Walkthrough for a single person business:

Thanks for reading and I hope this helped you understand more about how a Health Spending Account saves your small business money!

Related Reading:

Top 19 FAQ about a Health Spending Account for small business

Top 53 FAQ about Olympia Health Spending Account Plans

How does a Health Spending Account work for small business