Are you a part of the influential wave of millennial financial advisors in Canada?

To remain competitive, you'll need to add this critical tax planning tool to your arsenal of products.

Here's how to present a Health Spending Account to your small business clientele.

What is a Health Spending Account?

Contrary to what you might think, a Health Spending Account (also known as a HSA, Private Health Services Plan, PHSP, Cost Plus Program, or Healthcare Spending Account) is not an insurance plan. It's a tax plan for incorporated business owners in Canada. The HSA has been around for over 20 years and is used by tens of thousands of business owners across Canada.

Specifically, the HSA is a contract established between an employer (a corporation) and an employee (owner of the corporation). The conditions of the contract enable the owner to withdraw money from their corporation on a tax free basis to pay for 100% of their personal medical expenses. The corporation is able to deduct 100% of the withdrawls.

Why should I care about the HSA?

There are significant savings available to your client when they pay for their medical expenses through a Health Spending Account as opposed to traditional health insurance.

Your small business clients, let's say specifically incorporated professionals and family business owners, have 3 options to pay for their medical expenses:

1. Traditional Health Insurance

2. No insurance (self insure)

3. Health Spending Account

Let's take a look at a case study and see how the potential savings with a Health Spending Account. But first, you need to understand the nature of medical expenses in Canada.

Medical Expenses are Personal, After Tax Expenses

Whether your small business client is paying for their health and dental premiums, paying for deductibles or any out of pocket medical expenses, these are all considered after tax expenses. That $100 dental bill is going to cost far more to the business when you factor in taxes. Your client earning $100,000 (with a marginal tax rate of 43%) will have to gross $178 to pay for the $100 dental bill.

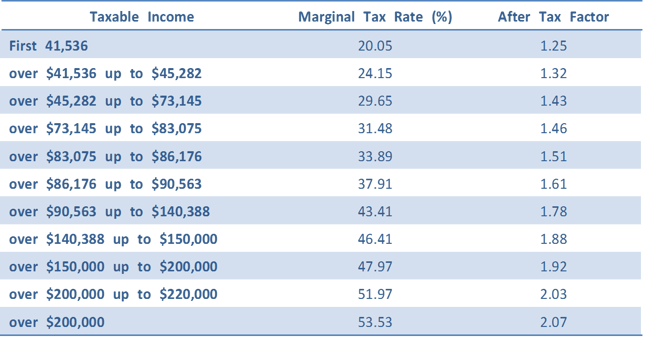

Put differently, imagine your client's corporation is an ATM. When they withdraw money from the ATM in the form of a T4 salary or management fee, they are subjected to progressive personal income tax rates in the table below. To get $1 in their hands, after tax, they need to gross $1.78 because 78 cents or 43% is paid in taxes.

Marginal Tax Rates in Ontario

The Cost of Maintaining Your Health

We analyzed over 1,000,000 claims and discovered the average Canadian is spending around $800 per year to maintain their health. This means a family of 4 will have approximately $3,000 in expenses per year visiting the dentist, getting prescription drugs, seeing a physio therapist (IE maintaining their health).

For each of the three options above, let's take a look how much a family would spend on their healthcare costs:

1. Traditional Insurance Plan

Under this format, the family would spend approximately $400 per month / $4,800 per year on health and dental insurance premiums. We can also safely assume there would be an additional $1,000 in out of pocket / deductibles.

Annual Premiums for Health Plan ($4,800) + Deductibles ($1,000) = $5,800.

Keep in mind $5,800 is an after tax, personal expense. This means they need to gross additional income to pay for the tax. In this case, the family would need to gross $10,300 ($5,800 is what remains after you pay 43% income tax).

2. No Insurance Plan

My incorporated professionals and family business owners have no health and dental insurance. They plans are restrictive, expensive, and poorly designed for a business of that size.

Under this option, the family would directly pay for their $3,000 medical expenses out of pocket with after tax dollars. The total, before tax cost, would be approximately $5,400 (same math as above).

3. Health Spending Account

What would happen if the family opted to pay for their $3,000 through their company as opposed to personally? In other words, how much money could the family save if they paid for their medical expenses with before tax dollars?

This chart helps to show the savings comparison:

By paying for their medical expenses through a Health Spending Account (on the right, labeled as "Before Tax") as opposed to After Tax (left), the family business can save over $2,000 in taxes.

The $499 annual fee is the cost for the Olympia HSA.

How do I market the Olympia HSA?

Hopefully this article provided you with an idea on how to approach your small business clients and perhaps to better understand the value created by a Health Spending Account. Please download our free Olympia Partner Guide to Health Spending Account to discover how to incorporate the Olympia HSA into your product mix or visit our Partner Page.