Whether you are looking for a new career, hoping to supplement your existing income or have the next greatest business idea, starting your own business is the way to go! Starting a business means that you are self-employed and from tax perspective this could be beneficial for you. However, this is also a daunting task as you will be the President, CEO, and staff, all rolled into one. This takes a lot of guts, a tolerance for risk and a motivated hard worker but there could also be some tax breaks available. It is essential for you to follow the rules established by the tax department, ensure you are aware of the deductible expenses available, and have set up a system to keep track of those expenses to ensure you pass any scrutiny by the tax department.

What are some common self employed tax deductions in Canada?

Once you decide to start a business, whether it be part time or full time, there are a number of expenses that are deductible from the income you earn. The tax act provides some guidelines as to what can and cannot be deducted but these guidelines are limited to a few specific items. For those items not specifically identified, the rule is that the expense must have been incurred for the purpose of earning income and that the expense is reasonable.

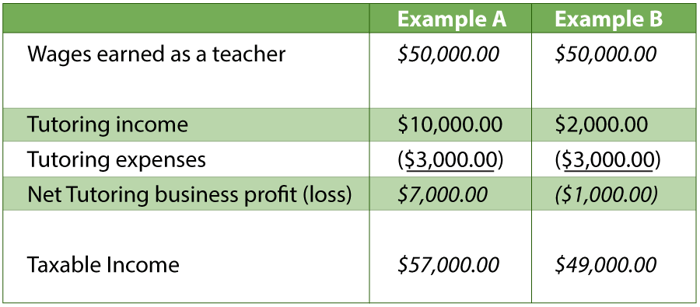

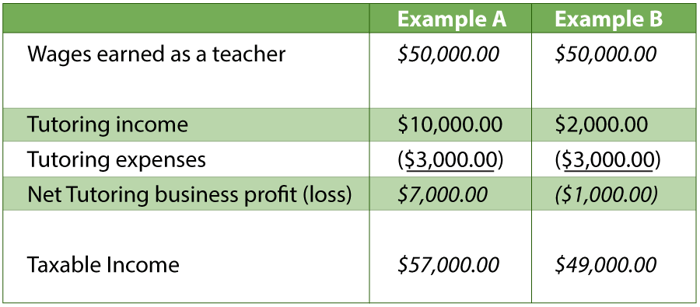

If your expenses for a calendar year exceed your income, you will have a business loss. This loss can offset any other income that you earned in the year but conversely, if your business made a profit in a calendar year, then that income is added to all other income earned in the year and be taxed accordingly. For example. If you have a tutoring business in addition to your regular job as a teacher, here is how both a profit and a loss would be taxed:

Expenses that are usually deductible at the full amount paid:

- Accounting and legal fees

- Advertising, promotion and marketing

- Bank charges and business interest

- Business licenses, dues, memberships, subscriptions

- Delivery and freight expenses

- Insurance

- Office supplies

- Purchases of goods for re-sale

- Rent and utilities

- Sub-contractor fees

- Supplies

- Telecommunications

- Travel

- Wages and benefits for staff

Some business related expenses may also have a personal nature to them and thus only the business portion of the expenses are deductible. Common expenses that have both a business and personal nature include:

- Automobile

- Cellular phone

And then there are those expenses that have specific tax rules attached to them that include:

- Meals and entertainment where you are only allowed to deduct 50% of the cost

- Business and electronic equipment purchases where the deduction ranges from 1% to 100% of the cost depending on what kind of business equipment is purchased

- Home office costs where there are several rules that include limiting the claim to the space used for the business versus the total space of the home, to only allowing the claim for the operating expenses of the home (no renovation or improvement costs can be claimed) and whether or not your business made a profit or a loss in the year.

Tracking your Expenses

Keeping track of the business expenses will help you when it comes to filing your tax return but luckily, there is no specified method recommended by CRA with regards to record keeping. Rather, the onus is on you, the business owner, to be able to confirm to CRA how you were able to derive at the amounts that were listed on your tax return. Accordingly, you could use a spreadsheet program, tally your receipts with an adding machine or you could use an accounting program. The method that you choose is up to you but the more volume your business does, whether or not you are registered for GST/HST, or if you have complex calculations such as payroll, make sure to use a system that works for you and CRA. You are able to change bookkeeping methods at any time so if you are unsure of where to start, make sure to discuss your options with your accountant.

Self Employed with a High Tax Bracket?

If your business income results in your overall taxable income increasing enough to make you jump tax brackets, you may wish to consider incorporating but make sure to discuss this option with your accountant before you take this step as there are both pros and cons to operating your business via a corporation.

An accountant that has helped many small business owners and startup companies will be able to help you navigate the tax complexities of being self-employed so be sure to get professional advice from a Chartered Professional Accountant before you take this life changing step.

Health and Dental Tax Deductions for the Incorporated

Small business owners and incorporated individuals in Canada can use a Health Spending Account (HSA) to save on their medical expenses. An HSA is a cost effective alternative to traditional health insurance. The plan covers a wide variety of health and dental expenses. You could save thousands of dollars in taxes with an HSA.

Gabrielle Loren, CPA, CGA is the founding partner of Loren Nancke, a professional accounting firm with offices in North Vancouver and New Westminster, BC. 604-904-3807