In Canada, most health care costs are covered under the provincial (public) health care system. However, their are some expenses which slip through the cracks like eye care, dental, or prescription drugs. How should Canadians address these expenses?

In this article, we highlight the two ways for a business owner to pay for medical expenses through an infographic:

Note: The information in this article is best suited for a small business owner or self employed individual (ex. contractor)

Private health insurance is a common way to pay for medical expenses, but that doesn't mean it is the best.

According to a CBC article, for every $1.00 that Canadians were paying to private health insurance, they were only getting $0.92 cents back (in value) in 1991. Fast forward to 2011, Canadians were paying a dollar and getting $0.74 cents.

If we look at this correlation, the amount paid back will be even lower in 2018. Some estimate that for every dollar you pay, only about $0.60 in value comes back to the employee in the form of a reimbursement. While you might think this money goes toward pooling, you would be incorrect in assuming so because most small business insurance plans never reach the sheer numbers required for the insurance to actually take effect.

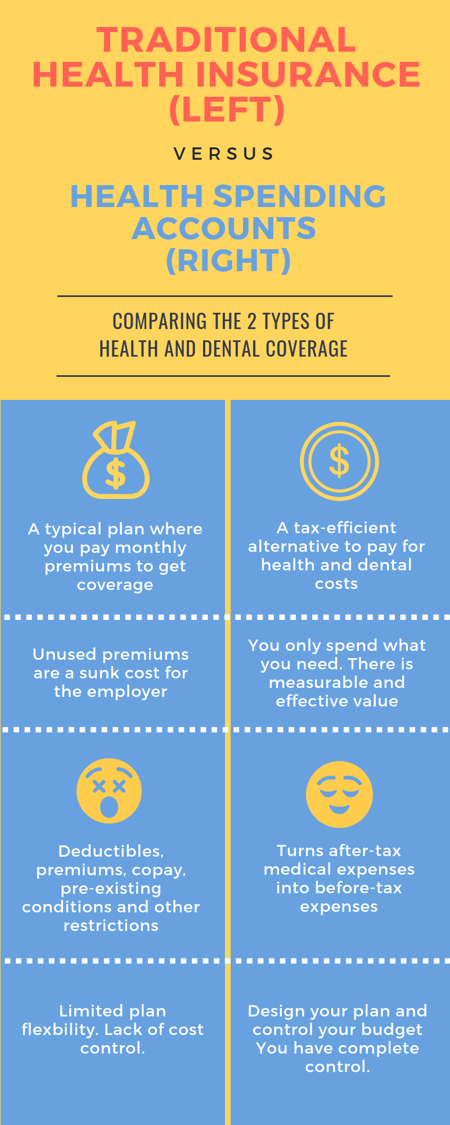

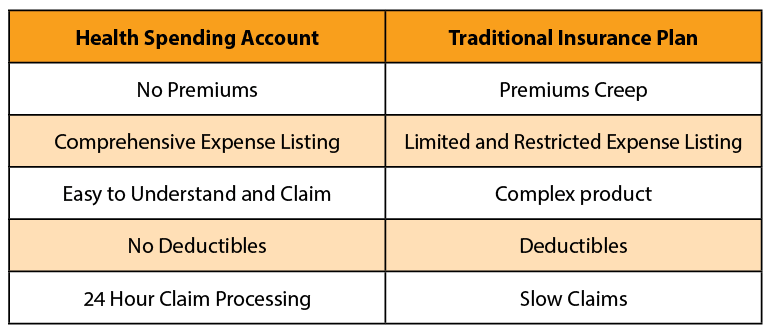

The below infographic compares a traditional plan to a Health Spending Account (HSA).

.png?width=450&name=Ways%20to%20Pay%20for%20Medical%20Expenses%20-%20Infographic%20(1).png)

.png?width=450&name=Ways%20to%20Pay%20for%20Medical%20Expenses%20-%20Infographic%20(3).png)

Olympia Benefits serves over 54,000 clients and over the years, we’ve come to realize that some business owners are paying upwards of $10,000/year on health insurance premiums alone… and that’s with after-tax dollars.

That is never the case with a Health Spending Account. It was created by the CRA as a tax plan that provides tax relief and tax shelter for small business owners specifically.

A Health Spending Account provides wide coverage and 100% cost control. Any health-related cost is typically eligible.

Summary:

In most cases, you are better off paying for your medical expenses out of pocket and then using a Health Spending Account to turn these personal medical expenses into before-tax business deductibles. That means the money saved (by bypassing tax) is kept in the corporation, and can be used for other financial needs such as investing or financing. It’s a win/win.

Re-assessing your insurance plan or provider?

Making the switch to a HSA is worth it.

However, in the case that you decide not to switch or keep a spousal insurance plan, you should know that small business owners can deduct their health insurance premiums (as a business expense) by using a Health Spending Account (HSA). Basically, you can pay for your health insurance premiums with before-tax dollars.

Will a Health Spending Account (HSA) work with insurance?

A Health Spending Account can supplement your health insurance by eliminating taxes on premiums. Many people pay high, increasing premiums under a traditional health insurance plan. With a Health Spending Account, you can claim these premiums as a business expense. You can even claim deductibles, copays, or any associated cost related to your health and dental plan. Any medical expense NOT reimbursed by your health insurance plan is also eligible under an HSA plan.

Read the Top 53 FAQ about Olympia Health Spending Account plans.

Is a Health Spending Account considered insurance?

No. While an HSA is in the "nature of insurance”, it is not insurance. Think of it as a tax benefit with some aspects of insurance.

Are Health Spending Accounts legal?

Yes – an HSA is legal in Canada - as long as the guidelines are properly adhered to. Make sure you do your due diligence and choose a reputable provider.

If you are a small business owner with arm’s length employees, download this guide instead: