With thousands of options to choose from, creating an employee benefits plan for small business can be a complex decision. Without a doubt, health and dental benefits are some of the top rated benefits. However, traditional insurance plans can be costly for small businesses.

In this guide, we will introduce a cost-effective alternative known as the Health Spending Account (HSA). This easy-to-use tax plan allows business owners to pay for medical expenses with before-tax dollars.

We created this guide to employee benefits, which includes 29 of the most frequently asked questions about using a Health Spending Account (HSA). Hopefully, it helps you determine what is best for your small business.

From our 20+ years of experience, these are the most frequently asked questions about group benefits and how a Health Spending Account (HSA) works in conjunction with group / employee benefits.

Note : This article is meant for a business owner with arm's length employees. If you own a business with no arm's length employees, I recommend reading our Top 19 FAQ for a Health Spending Account instead.

TABLE OF CONTENTS

(Click a question to be directed to its answer)

(Click a question to be directed to its answer)

- What are group benefits?

- Why should I have group benefits?

- What is a Health Spending Account (HSA)?

- How can an HSA complement my existing group benefits package?

- How does it work?

- Why can’t I just pay my employees directly for their health and dental bill?

- How does an HSA compare to traditional health insurance?

- Why should a small business choose an HSA?

- Why should I choose Olympia for my HSA?

- What is the difference between Olympia’s 3 products?

- How much does an HSA cost?

- How do I know if the HSA GROUP plan is right for me?

- What would be an ideal setup for my company and employees?

- What are the eligible expenses?

- How do I submit a claim?

- How many employees can I enroll?

- Do we have to include all employees?

- Can I choose which employees to cover?

- How is an HSA funded?

- What is my spending limit?

- How is an employee reimbursed?

- When are employee benefits renewed under an HSA?

- Are my dependants covered under an HSA?

- How far back can an HSA be backdated?

- When can I close the plan?

- What happens to unused funds?

- Who makes the guidelines for eligible expenses?

- When was HSA created?

- Why are HSAs less common than insurance?

FREQUENTLY ASKED QUESTIONS (FAQ)

1. What are group benefits / employee benefits?

Group benefits are non-wage compensations that you can offer your employees as an added bonus.

Examples (here are a few):

- Flexible schedules

- Additional vacation time

- Sign-on bonuses

- A health and dental plan

- Life insurance

- Disability insurance

2. Why should I have group benefits / employee benefits?

Employee benefits are becoming commonplace in many work environments. A happy and healthy employee means a productive employee. As a result, many companies are offering additional health packages. Employee benefits are great incentives for potential recruits, and help in both attracting and retaining top talent.

3. What is a Health Spending Account (HSA)?

A Health Spending Account (HSA) is a way to provide health and dental benefits to your employees. It is a tax tool that acts as an alternative to traditional health insurance. It allows the employer to provide health benefits to its employees using non-taxable / tax-free dollars.

Note: This tax plan is for incorporated business owners.

4. How can an HSA complement my existing group benefits package?

A Health Spending Account (HSA) is a cost-effective and flexible addition to a company’s group benefits / employee benefits. It is a modern health and dental care plan which offers flexibility and cost-effectiveness that most traditional insurance providers typically don’t have. This type of benefits package is particularly useful for small business, consultants, and mom & pop owners because it offers a budget friendly and proactive approach to your benefits. It can even work in conjunction with traditional health insurance, by covering any missed coverage.

Note: Insurance premiums, deductibles and other associated costs, and non-reimbursed medical expenses can be claimed through an HSA.

5. How does it work?

The employer allocates money into a funding account with Olympia Benefits. Your employees can access these funds to pay for medical expenses tax free. Yes, even the ones not covered by your insurance or provincial medical plan. The money is a tax deductible for the company and is 100% tax free for your employee, meaning they get to use all the money distributed to them.

6. Why can't I just bill my employees directly for their health and dental bill/expense?

If you reimburse employees directly, then they pay income tax on all your reimbursements. Through Olympia, we can turn reimbursements into a non-taxable benefit (100% tax free) for your employees. As a professional administrator, we work with the CRA to maintain integrity within each individual health and dental plan. We make sure claims run smoothly and employees are reimbursed in a timely manner (typically 1-2 business days).

7. How does an HSA compare to traditional insurance?

- No monthly premiums

- No price increases on renewal

- Wide coverage with few restrictions

- No complex or hidden policies – simply pay for your medical expenses and get reimbursed

- Customize your own plan - create employee classifications and limits (full time, part time, manager, VP, etc.)

- Guaranteed cost savings (we can nail down your savings to the cent – calculate your HSA savings here)

Insurance carriers usually offer both HSAs and insurance but only advertise insurance solely because it makes much higher profit. That’s why you only see insurance on TV and radio (and media in general). It is estimated that for every $1.00 that goes to the insurer in the form of a premium, deductible or copay, the employee only receives $0.60 in value back. That means $0.40 of every $1.00 is spent on just administering and marketing the traditional insurance plan.

8. Why should a small business choose an HSA?

Traditional insurance plans typically come with one base price and aren’t budget friendly for small business owners. At the same time, they don’t provide your trusted employees with much lenience in terms of coverage. Anybody who has gotten a quote from an insurance provider understands the complex terms and conditions. With an HSA, you can create different spending limits based on your own employee classifications. You are in charge of the plan, every step of the way, from customization to monthly payments.

Note: In the below sections, I will talk more about using the Olympia HSA plan.

9. Why should I choose Olympia for my Health Spending Account?

Here's 5 reasons why Olympia is the future of small business group benefits.

- Our prices are available for everyone to see. No hidden fees.

- Your claim will be processed in 2 days. Fast and simple digital claims.

- More than 58,000 small businesses choose Olympia. Performance you can trust.

- We’ve been in this industry for 20+ years. Experienced in all aspects.

- Our top priority is educating small business owners. Many dedicated resources.

Note: 5 reasons why you should choose Olympia as your HSA provider.

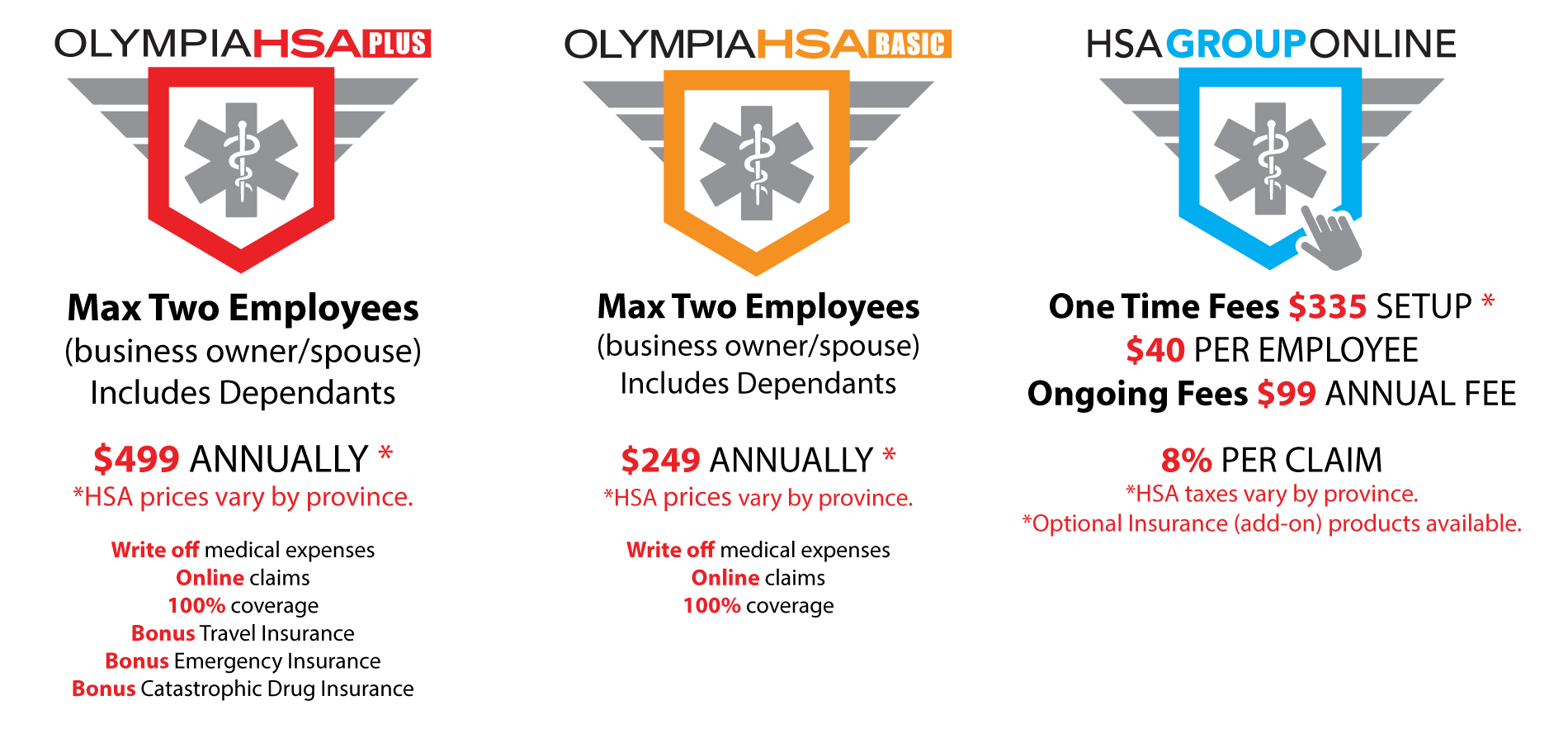

10. What is the difference between Olympia’s 3 HSA products? (HSA GROUP / PLUS / BASIC)

The HSA GROUP is for a business with arm's length employees. (See below)

The HSA PLUS and BASIC works for family businesses (owner + spouse only).

11. How much does an HSA cost?

Olympia specializes in serving small business. Our HSA plans are cost effective with no hidden fees.

Each HSA plan (PLUS / BASIC / GROUP) has its own unique cost structure.

For more on HSA plan pricing, check our website.

12. How do I know if the HSA GROUP Plan is right for me?

This product is made for a company with at least one “arms-length” employee. For example, a restaurant owner with 2 arm's length employees will qualify for the HSA GROUP plan.

13. What would be an ideal set up for my company and employees

To summarize: there is no ideal set up. You are in control of the budget and can choose to increase or decrease the spending limit for your employees. We can offer advice based on your performance after 1 year. Employers often ask "how much should I budget for my employee benefits?"

- Determine your current (health and dental plan) budget

- Allocate it to employees (proportionately over the plan year) through a funding account

These funds are 100% tax free, meaning employees can use them on eligible expenses up to their spending limits. This provides cost control for the employer and choice for employees. In most cases, the spending limit is never completely used. Remaining funds will be returned to the employer or can be left for next year’s budget.

14. What are the eligible HSA expenses?

Note: Click here to see all eligible HSA expenses.

If your medical expense is not listed, send us a message (bottom right for live chat) or call: 1-888-668-8384.

Some of the most frequently claimed eligible expenses include laser eye surgery, dental treatment, physiotherapy, massages, eyeglasses, and prescription drugs. In most cases, an expense will qualify as long as it is related to a personal medical requirement.

NOTE: All questions and answers below are pertaining to the HSA GROUP plan only.

15. How do I submit a claim?

Example - here’s how a claim would work for a $1,000 medical expense.

- The employee pays for the $1,000 medical expense using their own funds.

- The employee logs into their personal HSA account with Olympia and submits the details of their receipt online. The employee holds on to the original receipt.

- Olympia takes funds from the company’s funding account to reimburse the employee directly for their claim. A direct deposit of $1,000 (tax-free) will be made to the employee’s personal bank account.

The $1,000 reimbursement is TAX FREE.

The $1,000 payment from your corporation is TAX DEDUCTIBLE.

This process (including reimbursement) usually occurs within 2 days (48 hours).

16. How many employees can I enroll?

No maximum. They can be split into classifications with different spending limits.

17. Do we have to include all employees?

You DO NOT have to include all employees. However, there must be reasonable conduct within the plan, meaning the plan CANNOT include ONLY the owner. That scenario would conflict with the rules of an HSA. It would appear to be a shareholder benefit as opposed to an EMPLOYEE BENEFIT. As a result, we recommend that you include AT LEAST one class of full time employees.

18. Can I choose which employees to cover?

The employer can select employee classifications to include in the plan, as well as the spending limits for each employee classification (ex. Associate, Manager, VP, President).

19. How is an HSA funded?

The HSA is funded by the employer.

The employer determines the funding amount and spending limits. We recommend allocating a sufficient amount at the start of the plan so that employees can be reimbursed immediately after a successful claim. This funding amount should be determined by your company’s number of employees and spending habits.

20. What is my spending limit?

The spending limit is determined by the employer, with a maximum of $15,000 and minimum of $500 per employee. The spending limits are based on classifications. Each classification is assigned their own spending limit. Although there are no specific rules in place, spending limits between classifications should be reasonable. This ensures fairness between the employer and employees. It is suggested to maintain a maximum ratio of 10:1 between the employer and employees.

21. How is an employee reimbursed?

We reimburse the employee directly by depositing funds into their personal bank account.

Note: All reimbursements are 100% tax free.

22. When are benefits renewed under an HSA?

HSA Group - any day can be chosen; this is selected by the employer.

23. Are my dependants covered under an HSA?

Dependants are eligible. Click here to see the HSA dependant requirements.

24. How far can the HSA be backdated?

The earliest ANY plan can be made effective is the date the application is completed and paid for online (a.k.a. the day you sign up).

Additional insurance products (if purchased) have varied effective dates in accordance with policy guidelines. See the Plan Guidelines for full details.

25. When can I close the plan?

The employer can terminate an HSA plan at anytime. There are ZERO costs associated with terminating a plan.

26. What happens to unused funds?

Olympia can give a full refund to the employer at any time. Remember, a deposit for the HSA funding account is not the same as a premium payment to insurance. You can withdraw funding from your HSA account at ANY time.

Here are some interesting facts about a Health Spending Account (HSA):

27. Who makes the guidelines for eligible expenses?

The Canadian Revenue Agency (CRA) is responsible for creating the eligible expense guidelines.

28. When was an HSA created?

An HSA has been available to Canadians since the 80’s. Olympia has been offering Health Spending Accounts since 1997, and has been very active in the promotion and education of this government approved tax plan.

29. Why are HSAs less common than insurance?

It all comes down to numbers. Insurance plans bring in much higher profitability than your average Health Spending Account. As a result, financial companies advertise insurance products on a much higher scale (in the mainstream media such as radio or TV). In recent years, small businesses have begun searching for alternatives. Paired with the digital era and greater educational resources, we see a growing demand for Health Spending Accounts.

Thanks for reading ~ you made it all the way through! You know your stuff when it comes to Health Spending Accounts now.

To learn more about Olympia’s HSA GROUP plan, download our COMPLETE guide:

This guide covers:

-

How to customize your plan through easy online submission

-

How to fund your plan (in detail)

-

How you can cover your employees with additional insurance products

…or if you’re ready to sign up and get access to thousands in tax-savings, CLICK HERE

You can sign up and make your first claim in under 5 minutes.

Related Reading:

What employee benefits should you offer?

What employee benefits do millennials want?

Don't fall for these 7 employee benefits myths

Top 24 FAQ for Employee Benefits Packages for Small Business